Alberta electricity policy

In 1996, Alberta began to restructure its electricity market away from traditional regulation to a market-based system. The market now includes a host of buyers and sellers, and an increasingly diverse infrastructure.

Consumers range from residential buyers to huge industrial consumers mining the oil sands, operating pipelines and milling forest products. On the supply side, generators range from wind farms east of Crowsnest Pass to huge coal-fired plants near Edmonton. The diversity of Alberta's electricity supply has increased substantially. To a large extent because of deregulation, the province has more technology, fuels, locations, ownership, and maintenance diversity than in the past. The system's reliability, its cost structure and Alberta's collective exposure to risk are now met by a complex system based on diverse power sources, mainly coal and natural gas, with some wind and hydroelectric energy sources.

History

The Alberta Government passed the Electric Utilities Act(1996) effective January 1, 1996 which created Power Pool of Alberta, a wholesale market clearing entity. The Power Pool was a not for profit entity that operated the "competitive wholesale market including dispatch of generation."[1] The Electric Utilities Act stipulated all electric energy bought and sold in Alberta had to be exchanged through the Power Pool which "served as an independent, central, open access pool." It functioned as a "spot market intending to match the demand with the lowest cost supply and establish an hourly pool price."[1] Alberta was the first Canadian province to implement a deregulated electricity market. Competitive wholesale markets were being fostered in the 1990s as part of the liberalization process of the 1990s changing some parameters such as the unbundling of generation, transmission and distribution functions of incumbent utilities.[2] Local distribution utilities, either investor- or municipally owned, retained the obligation to supply and the 6 largest utilities were assigned a share of the output of existing generators at a fixed price. The province moved to full retail access in 2001. In 2003 The Alberta Electric System Operator was established under the provisions of the Electric Utilities Act,[1] and through the AESO, a spot market was created. After consumers complained about high prices in 2000, the government implemented a Regulated Rate Option (RRO), as a means to shield consumers from price volatility.[3]

The generation sector in Alberta is dominated by TransAlta (formerly Calgary Power), ENMAX, and Capital Power Corporation, a spin-off of Edmonton's municipally owned company EPCOR. Utility companies in Alberta also include the wind generating Bullfrog Power, TransAlta Corporation, Alberta Power limited, AltaLink, ATCO Power and FortisAlberta. Although 5,700 megawatts of new generation was added and 1,470 of old plants were retired between 1998 and 2009,[4] coal still accounted for 73.8% of utility-generated power in 2007, followed by natural gas, with 20.6%.[5]

Installed capacity reached 12,834 megawatts in 2009, with coal (5,692 MW) and natural gas (5,189 MW) representing the bulk of the province's generation fleet. As of 2008, Alberta's electricity sector was the most carbon-intensive of all Canadian provinces and territories, with total emissions of 55.9 million tonnes of CO

2 equivalent in 2008, accounting for 47% of all Canadian emissions in the electricity and heat generation sector.[6]

In 2013, electrical generation consisted of coal (55%), natural gas (35%), renewable and alternative sources (11%).[7]

By 2010 wind capacity had reached 657 MW and hydroelectric capacity produced 900 MW.[4] In June 2010 the federal government announced tougher new emission measures. Alberta will likely remain dependent on coal generated electricity into 2050.[8]

Market components

Alberta's electricity market consists of five fundamental components and features.

- Seventeen firms supply electricity into the grid. Five of those providers - ATCO Power, Enmax, Capital Power Corporation, TransAlta and TransCanada Corp. - supply about 80% of the province's generation capacity.

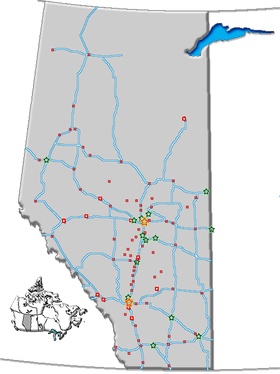

- Alberta's transmission grid, owned in sections by companies like TransAlta, AltaLink and ATCO Electric, then carries electricity produced by generating providers to wholesale electricity purchasers or retailers.

- The Alberta Electric System Operator (AESO)[9] leads the planning and operation of the power system, facilitates competitive power markets. Also, it ensures and manages open access to the grid.

- There are about 160 wholesale electricity purchasers, many of which are also resellers to other end-users like ENMAX, EPCOR, FortisAlberta, and Direct Energy.

- Retail consumers have the option to buy electricity at competitive prices from third-party sellers like Just Energy or at regulated prices through the local utility like ENMAX and EPCOR.

- The Market Surveillance Administrator[10] ensures that Alberta's electricity markets are fair, efficient and competitive.

AESO

While generation companies (e.g., EPCOR) continue to own both generation and transmission in Alberta, the Alberta Electric System Operator (AESO) which is "independent of any industry affiliations and owns no transmission or market assets" has transmission control.[11] The Alberta Minister of Energy appoints the members of AESO's board.[11] "[It] is governed by an independent board, which has a diverse background in finance, business, electricity, oil and gas, energy management, regulatory affairs and technology. The Board's governance strategy is founded on balancing the interests of a diverse set of stakeholders, while at the same time, providing benefit for the overall industry stakeholder needs. (AESO cited in Brennan 2008:9)."[11]

Supply interdependence with British Columbia

Alberta and neighbouring British Columbia are buyers and sellers of each other's power. Historically, Albertans buy from B.C. during peak hours. Similarly, B.C. buys from Alberta frequently during off-peak periods (weekends, evenings, or statutory holidays when demand in Alberta diminishes). This arrangement confers benefits on both provinces.[12]

The power-exchanging relationship between the two provinces is based on geography. Alberta has coal and natural gas, while B.C. has big mountains, long valleys and historically an abundance of water resources. As a result, B.C. based its system on hydroelectric power while Alberta constructed one that primarily burns hydrocarbons, mostly coal. Over the years the two provinces have evolved an interdependent relationship.

Alberta's electrical demand varies throughout the day and across the seasons. When individuals are fixing supper and using home appliances, demand for power goes up, as it does during heat waves and cold snaps. It tapers off during spring and fall. Like other mechanical devices, generators fail from time to time. If they are wind-powered, their output varies with the wind.

Whether for reasons of temporary high demand, short supply or both, Alberta buys electricity from its western neighbour through the Power Power Power of Alberta. By contrast, Alberta might sell electricity to British Columbia during off-peak periods. During that period, B.C. uses that power to reduce its hydroelectric generation.

Alberta buys electricity from B.C. during periods of peak consumption, on unusually cold or hot days or when a larger-than-normal number of generators are down for maintenance. British Columbia buys electricity from Alberta during off-peak periods. This arrangement enables both provinces to make use of their generating and storage capacity and use assets more efficiently. Also, it keeps power prices lower in both provinces than they would otherwise be.

This arrangement evolved because of physical differences between the two electrical systems. It depends little on differences in the two market models.

Market models

The differences between Alberta's and British Columbia's market models represent the two extremes in use within Canada. Alberta has developed a system in which markets determine prices and the pace of investment. B.C. has a conventional cost of service regulated power system (that exists in most of Canada and most of the United States).

Despite the vast differences in market design and because of large differences in the mix of generation assets, the electricity systems of Alberta and British Columbia enjoy a unique symbiotic relationship. B.C. provides a market for Alberta's off-peak surplus and a peaking supply for Alberta's crunch periods. The investment climate in Alberta has attracted a steady stream of private investors-funded generation projects since 1996. This is one of the reasons Alberta's electricity system has provided reliable, sustainable power even during periods of rapid economic growth.

Cost of electricity in Alberta

In April 2013, Calgary ranked third (with an average monthly payment of $216[13] based on a monthly consumption of 1,000 kWh) and Edmonton fourth ($202 a month) in Canada compared to other cities in terms of high electricity bills. Halifax placed first and worst in Canada at $225[13] a month. Compared to other cities in North America, Calgary and Edmonton placed seventh and eighth in terms of highest power costs.[14] Vancouver, BC was among the least expensive($130 a month).[13]

The unit price of electricity in Calgary in April 2013 was 14.81 cents per kWh, compared to 6.87 cents per kWh in Montreal, 15.45 in Halifax.[15]

Keith Provost, former senior vice-president of Alberta Power Ltd. (now ATCO Power), with decades of experience in the electrical utilities business, argued that instead of marketing electricity contracts for future deliveries in a regulated market, AESO has their own system that is open to manipulation and is not a free-market system. According to AESO, "The pool price is the arithmetic average of the 60 one-minute system marginal prices. Only those offers accepted generate power and receive the AESO pool price. All offers accepted receive the same price, the pool price, not the price offered."[16] It is this deregulated system that causes volatility in the price of electricity, keeps consumer prices high while maximizing profits to generating companies.[16]

See also

- Hydro-Québec's electricity transmission system

- Manitoba Hydro

- Ontario electricity policy

- SaskPower

- Coal in Canada

Citations

- 1 2 3 Manning nd.

- ↑ International Energy Agency 2009, pp. 193–195.

- ↑ Deewes, Donald N. (9–10 September 2005), "Electricity Restructuring and Regulation in the Provinces: Ontario and Beyond" (PDF), Energy, Sustainability and Integration. The CCGES Transatlantic Energy Conference, Toronto, retrieved 2010-09-06

- 1 2 Government of Alberta, Electricity Statistics, Energy Alberta, retrieved 2010-09-06

- ↑ Statistics Canada 2009, pp. 20–21

- ↑ Environment Canada (15 July 2015). National Inventory Report Greenhouse Gas Sources and Sinks in Canada 1990–2008 (3 volumes). UNFCCC.

- ↑ https://www.iea.org/publications/freepublications/publication/EnergyPoliciesofIEACountriesCanada2015Review.pdf pg186

- ↑ O'Meara, Dina (23 June 2010), "Industry needs time to move from coal-fired power", Calgary Herald, Calgary, retrieved 2010-09-06

- ↑ Alberta Electric System Operator

- ↑ Market Surveillance Administrator

- 1 2 3 Brennan 2008, p. 19.

- ↑ The battery and the charger

- 1 2 3 Hydro Quebec 2013, p. 9.

- ↑ Hydro Quebec 2013.

- ↑ Hydro Quebec 2013, p. 4.

- 1 2 Provost 2013.

References

- "About AESO", Alberta Electric System Operator, nd, retrieved 22 December 2013

- Brennan, Timothy J. (April 2008), Generating the Benefits of Competition: Challenges and Opportunities in Opening Electricity Markets (PDF) (260), Toronto, Ontario: C.D. Howe, ISBN 0-88806-737-2, ISSN 0824-8001, retrieved 22 December 2013

- "Alberta's power lines too full for expanding wind farms", CBC News, Calgary, Alberta, 20 October 2006, retrieved 22 December 2013

- Liebrecht, Richard (22 September 2009), Residents want west-end transmission line buried, Sun Media, retrieved 22 December 2013

- "Alberta hit by rolling power blackouts: 'Great concern' grid would go down, Calgary mayor says", CBC News, Edmonton, Alberta, 9 July 2012, retrieved 22 December 2013

- "Comparison of Electricity Prices in major North American Cities: Rates in effect April 1, 2013" (PDF), Hydro Quebec, 2013, retrieved 22 December 2013

- "Energy Policies of IEA Countries - Canada 2009 Review", International Energy Agency, Paris: OECD/IEA, p. 264, 2009, ISBN 978-92-64-06043-2

- Provost, Keith (21 December 2013), "Opinion: Unplugging myths about our electricity prices: Consumers bearing the high costs of a faulty, deregulated system", Edmonton Journal, Edmonton, Alberta

- Manning, Lewis L. (nd), The State of Electricity De-Regulation in Alberta and the Alberta Electric System Operators Role (PDF), retrieved 22 December 2013