United States Balance of trade

History

The 1920s marked a decade of economic growth in the United States following a Classical supply side policy.[2] U.S. President Warren Harding signed the Emergency Tariff of 1921 and the Fordney–McCumber Tariff of 1922. Harding's policies reduced taxes and protected U.S. business and agriculture.[3] Following the Great Depression and World War II, the United Nations Monetary and Financial Conference brought the Bretton Woods currency agreement followed by the economy of the 1950s and 1960s. In 1971, President Richard Nixon ended U.S. ties to Bretton Woods, leaving the U.S. with a floating fiat currency. The stagflation of the 1970s saw a U.S. economy characterized by slower GDP growth. In 1988, the United States ranked first in the world in the Economist Intelligence Unit "quality of life index" and third in the Economic Freedom of the World Index.[4]

Over the long run, nations with trade surpluses tend also to have a savings surplus. The U.S. generally has developed lower savings rates than its trading partners, which have tended to have trade surpluses. Germany, France, Japan, and Canada have maintained higher savings rates than the U.S. over the long run.[5]

Impacts

Some economists believe that GDP and employment can be dragged down by an over-large deficit over the long run.[6][7] Others believe that trade deficits are good for the economy.[8] The opportunity cost of a forgone tax base may outweigh perceived gains, especially where artificial currency pegs and manipulations are present to distort trade.[9]

Wealth-producing sector jobs in the U.S. such as those in manufacturing and computer software have often been replaced by lower paying wealth-consuming service sector jobs such as those in retail and government when the economy recovered from recessions.[10][11][12] Some economists contend that the U.S. is borrowing to fund consumption of imports while accumulating unsustainable amounts of debt.[1][13]

In 2006, the primary economic concerns focused on: high national debt ($9 trillion), high non-bank corporate debt ($9 trillion), high mortgage debt ($9 trillion), high financial institution debt ($12 trillion), high unfunded Medicare liability ($30 trillion), high unfunded Social Security liability ($12 trillion), high external debt (amount owed to foreign lenders) and a serious deterioration in the United States net international investment position (NIIP) (-24% of GDP),[1] high trade deficits, and a rise in illegal immigration.[13][14]

These issues have raised concerns among economists and unfunded liabilities were mentioned as a serious problem facing the United States in the President's 2006 State of the Union address.[14][15] On June 26, 2009, Jeff Immelt, the CEO of General Electric, called for the U.S. to increase its manufacturing base employment to 20% of the workforce, commenting that the U.S. has outsourced too much in some areas and can no longer rely on the financial sector and consumer spending to drive demand.[16]

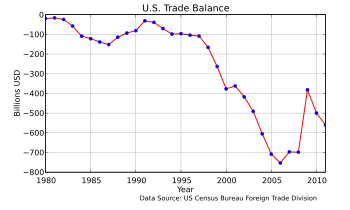

In 1985, the U.S.had just began a growing trade deficit with China. During the 1990s, U.S. trade deficit became a more excessive long-run trade deficit, mostly with Asia. By 2012, the U.S. trade deficit, fiscal budget deficit, and federal debt increased to record or near record levels following accompanying decades of the implementation of broad unconditional or unilateral U.S. free trade policies and formal trade agreements.[17][18]

The US last had a trade surplus in 1975.[19] However, recessions may cause short-run anomalies to rising trade deficits.

See also

References

- 1 2 3 Bivens, L. Josh (December 14, 2004). Debt and the dollar Economic Policy Institute. Retrieved on July 8, 2007.

- ↑ Joseph A. Schumpeter, "The Decade of the Twenties", American Economic Review vol. 36, No. 2, (May, 1946), pp. 1-10 in JSTOR

- ↑ "The Harding/Coolidge Prosperity of the 1920s". Calvin-coolidge.org. Retrieved 2009-03-30.

- ↑ Star Parker (December 17, 2012).Tea Partiers must hang tough.Urbancure.com

- ↑ The shift away from thrift.The Economist, April 7, 2005.

- ↑ Free Trade Bulletin no. 27: Are Trade Deficits a Drag on U.S. Economic Growth? | Cato's Center for Trade Policy Studies

- ↑ Causes and Consequences of the Trade Deficit: An Overview

- ↑ Trade Deficits Good News for U.S. Economy

- ↑ Bivens, Josh (September 25, 2006 ).China Manipulates Its Currency—A Response is Needed. Economic Policy Institute. Retrieved on February 2, 2010.

- ↑ Hira, Ron and Anil Hira with forward by Lou Dobbs, (May 2005). Outsourcing America: What's Behind Our National Crisis and How We Can Reclaim American Jobs. (AMACOM) American Management Association. Citing Paul Craig Roberts, Paul Samuelson, and Lou Dobbs, pp. 36–38.

- ↑ David Friedman, New America Foundation (2002-06-15).No Light at the End of the Tunnel Los Angeles Times.

- ↑ Sir Keith Joseph, Centre for Policy Studies (1976-04-05).Stockton Lecture, Monetarism Is Not Enough, with forward by Margaret Thatcher. (Barry Rose Pub.) Margaret Thatcher Foundation (2006).

- 1 2 Phillips, Kevin (2007). Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism. Penguin. ISBN 978-0-14-314328-4.

- 1 2 Cauchon, Dennis and John Waggoner (October 3, 2004).The Looming National Benefit Crisis USA Today

- ↑ George W. Bush (2006) State of the Union. Retrieved on April 17, 2009.

- ↑ Bailey, David and Soyoung Kim (June 26, 2009).GE's Immelt says U.S. economy needs industrial renewal.UK Guardian.. Retrieved on June 28, 2009.

- ↑ http://www.census.gov/foreign-trade/statistics/historical/gands.txt

- ↑ FTD - Statistics - Country Data - U.S. Trade Balance with World (Seasonally Adjusted)

- ↑ http://usinfo.org/enus/economy/trade/docs/06s1288.xls