Public economics

| Economics |

|---|

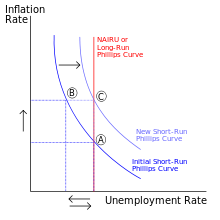

Phillips curve graph, illustrating an economic principle |

|

|

| By application |

|

| Lists |

|

Public economics (or economics of the public sector) is the study of government policy through the lens of economic efficiency and equity. At its most basic level, public economics provides a framework for thinking about whether or not the government should participate in economics markets and to what extent its role should be. In order to do so, microeconomic theory is utilized to assess whether the private market is likely to provide efficient outcomes in the absence of governmental interference. Inherently, this study involves the analysis of government taxation and expenditures. This subject encompasses a host of topics including market failures, externalities, and the creation and implementation of government policy. Public economics builds on the theory of welfare economics and is ultimately used as a tool to improve social welfare.[1]

Broad methods and topics include:

- the theory and application of public finance[2]

- analysis and design of public policy[3]

- distributional effects of taxation and government expenditures[4]

- analysis of market failure[5] and government failure.[6]

Emphasis is on analytical and scientific methods and normative-ethical analysis, as distinguished from ideology. Examples of topics covered are tax incidence,[7] optimal taxation,[8] and the theory of public goods.[9]

Subject range

The Journal of Economic Literature (JEL) classification codes are one way categorizing the range of economics subjects. There, Public Economics, one of 19 primary classifications, has 8 categories. They are listed below with JEL-code links to corresponding available article-preview links of The New Palgrave Dictionary of Economics Online (2008) and with similar footnote links for each respective subcategory if available:[10]

- JEL: H (all) – Public Economics

- JEL: H0 – General

- JEL: H1 – Structure and Scope of Government[11]

- JEL: H2 – Taxation, Subsidies, and Revenue[12]

- JEL: H3 – Fiscal Policies and Behavior of Economic Agents[13]

- JEL: H4 – Publicly Provided Goods[14]

- JEL: H5 – National Government Expenditures and Related Policies[15]

- JEL: H6 – National Budget, Deficit, and Debt[16]

- JEL: H7 – State and Local Government; Intergovernmental Relations[17]

- JEL: H8 – Miscellaneous Issues.[18]

Public goods

Public goods, or collective consumption goods, exhibit two properties; non-rivalry and non-excludability. Something is non-rivaled if one person's consumption of it does not deprive another person, (to a point) a firework display is non-rivaled - since one person watching a firework display does not prevent another person from doing so. Something is non-excludable if its use cannot be limited to a certain group of people. Again, since one cannot prevent people from viewing a firework display it is non-excludable.[9] Conceptually, another example of public good is the service that is provided by law enforcement organizations, such as sheriffs and police.[19] Typically, cities and towns are served by only one police department, and the police department serves all of the people within its jurisdiction.

Cost–benefit analysis

While the origins of cost–benefit analysis can be traced back to Jules Dupuit's classic article "On the Measurement of the Utility of Public Works" (1844), much of the subsequent scholarly development occurred in the United States and arose from the challenges of water-resource development. In 1950, the U.S. Federal Interagency River Basin Committee’s Subcommittee on Benefits and Costs published a report entitled, Proposed Practices for Economic Analysis of River Basin Projects (also known as the Green Book), which became noteworthy for bringing in the language of welfare economics.[20] In 1958, Otto Eckstein published Water-Resource Development: The Economics of Project Evaluation, and Roland McKean published his Efficiency in Government Through Systems Analysis: With Emphasis on Water Resources Development. The latter book is also considered a classic in the field of operations research. In subsequent years, several other important works appeared: Jack Hirshleifer, James DeHaven, and Jerome W. Milliman published a volume entitled Water Supply: Economics, Technology, and Policy (1960); and a group of Harvard scholars including Robert Dorfman, Stephen Marglin, and others published Design of Water-Resource Systems: New Techniques for Relating Economic Objectives, Engineering Analysis, and Governmental Planning (1962).[21]

Taxation

Diamond–Mirrlees efficiency theorem

In 1971, Peter A. Diamond and James A. Mirrlees published a seminal paper which showed that even when lump-sum taxation is not available, production efficiency is still desirable. This finding is known as the Diamond–Mirrlees efficiency theorem, and it is widely credited with having modernized Ramsey's analysis by considering the problem of income distribution with the problem of raising revenue. Joseph E. Stiglitz and Partha Dasgupta (1971) have criticized this theorem as not being robust on the grounds that production efficiency will not necessarily be desirable if certain tax instruments cannot be used.

Pigouvian taxes

One of the achievements for which the great English economist A.C. Pigou is known, was his work on the divergences between marginal private costs and marginal social costs (externalities). In his book, The Economics of Welfare (1932), Pigou describes how these divergences come about:

...one person A, in the course of rendering some service, for which payment is made, to a second person B, incidentally also renders services or disservices to other persons (not producers of like services), of such a sort that payment cannot be extracted from the benefited parties or compensation enforced on behalf of the injured parties (Pigou p. 183).

In particular, Pigou is known for his advocacy of what are known as corrective taxes, or Pigouvian taxes:

It is plain that divergences between private and social net product of the kinds we have so far been considering cannot, like divergences due to tenancy laws, be mitigated by a modification of the contractual relation between any two contracting parties, because the divergence arises out of a service or disservice to persons other than the contracting parties. It is, however, possible for the State, if it so chooses, to remove the divergence in any field by "extraordinary encouragements" or "extraordinary restraints" upon investments in that field. The most obvious forms which these encouragements and restraints may assume are, of course, those of bounties and taxes (Pigou p. 192).

Pigou describes as positive externalities, examples such as resources invested in private parks that improve the surrounding air, and scientific research from which discoveries of high practical utility often grow. Alternatively, he describes negative externalities, such as the factory that destroys a great part of the amenities of neighboring sites.

In 1960, the economist Ronald H. Coase proposed an alternative scheme whereby negative externalities are dealt with through the appropriate assignment of property rights. This result is known as the Coase theorem.

See also

Notes

- ↑ Serge-Christophe Kolm, 1987. "public economics," The New Palgrave: A Dictionary of Economics, v. 3, pp. 1047–55. Table of Contents.

- ↑ • Richard A. Musgrave, 2008. "public finance," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

• _____, 1959. The Theory of Public Finance: A Study in Public Economy. J.M. Buchanan review, 1st page. - ↑ • Dani Rodrik, 1996. "Understanding Economic Policy Reform," Journal of Economic Literature, 34(1), pp. 9–41. Archived June 6, 2013, at the Wayback Machine.

From The New Palgrave Dictionary of Economics Online, 2008. Abstract links for:

• behavioural public economics" by B. Douglas Bernheim and Antonio Rangel

• "fiscal federalism" by David E. Wildasin

• "hazardous waste, economics of" by Hilary Sigman.

• "nutrition and public policy in advanced economies" by Janet Currie. - ↑ The New Palgrave Dictionary of Economics, 2008, 2nd Edition. Abstract/contents links for:

• "public finance" by Richard A. Musgrave

• "consumption taxation" by James M. Poterba

• "distributive politics and targeted public spending" by Brian G. Knight

• "generational accounting" by Jagadeesh Gokhale

• "nutrition and public policy in advanced economies" by Janet Currie

• "progressive and regressive taxation" by William Vickrey and Efe A. Ok

• "redistribution of income and wealth" by F.A. Cowell

• "tax expenditures" by Daniel N. Shaviro

• "taxation and poverty" by John Karl Scholz

• "welfare state" by Assar Lindbeck.

• social insurance and public policy by Jonathan Gruber. - ↑ The New Palgrave Dictionary of Economics, 2008, 2nd Edition. Abstract links for:

• "market failure" by John O. Ledyard

• "bureaucracy" by Mancur Olson

• "health insurance, economics of" by Joseph P. Newhouse

• "mandated employer provision of employee benefits" by Jonathan Gruber

• "public goods" by Agnar Sandmo - ↑ • Sharun W. Mukand, 2008. "policy reform, political economy of," The New Palgrave Dictionary of Economics 2nd Edition. Abstract.

• James M. Buchanan, 2008. "public debt," The New Palgrave Dictionary of Economics 2nd Edition. Abstract.

• Mrinal Datta-Chaudhuri, 1990. "Market Failure and Government Failure," Journal of Economic Perspectives, 4(3) , pp. 25-39..

• Kenneth J. Arrow, 1969. "The Organization of Economic Activity: Issues Pertinent to the Choice of Market versus Non-market Allocations," in Analysis and Evaluation of Public Expenditures: The PPP System. Washington, D.C., Joint Economic Committee of Congress. PDF reprint as pp. 1-16 (press +).

• Joseph E. Stiglitz, 2009. "Regulation and Failure," in David Moss and John Cisternino (eds.), New Perspectives on Regulation, ch. 1, pp. 11-23. Archived February 14, 2010, at the Wayback Machine. Cambridge: The Tobin Project. - ↑ Gilbert E. Metcalf, 2008. "tax incidence," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

- ↑ Louis Kaplow, 2008. "optimal taxation," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

- 1 2 • Agnar Sandmo, 2008."public goods," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

• Serge-Christophe Kolm, 1987. "public economics," The New Palgrave: A Dictionary of Economics, v. 3, pp. 1047-48.

• Anthony B. Atkinson and Joseph E. Stiglitz, 1980. Lectures in Public Economics, McGraw-Hill, pp. vii-xi.

• Mancur Olson, 1971, 2nd ed.The Logic of Collective Action: Public Goods and the Theory of Groups, Harvard University Press, Description and chapter-previews links, pp. ix-x. - ↑ Of which a complete list with Wikipedia links is at JEL classification codes#Public economics JEL: H Subcategories

- ↑ JEL: H11 – Structure, Scope, and Performance of Government

JEL: H12 - Crisis management - ↑ JEL: H21 – Efficiency; Optimal taxation

JEL: H22 – Incidence

JEL: H23 – Externalities; Redistributive Effects; Environmental taxes and Subsidies

JEL: H24 – Personal Income and Other Nonbusiness Taxes and Subsidies

JEL: H25 – Business Taxes and Subsidies

JEL: H26 – Tax evasion - ↑ JEL: H31 – Household

JEL: H32 – Firm - ↑ JEL: H40 – General

JEL: H41 – Public goods

JEL: H42 – Publicly Provided Private Goods

JEL: H43 – Project Evaluation; Social Discount Rate

JEL: H44 - Publicly Provided Goods: Mixed Markets - ↑ JEL: H51 – Government Expenditures and Health

JEL: H52 – Government Expenditures and Education

JEL: H53 – Government Expenditures and Welfare Programs

JEL: H54 – Infrastructures; Other Public Investment and Capital Stock

JEL: H55 – Social security and Public Pensions

JEL: H56 – National Security and War

JEL: H57 – Procurement - ↑ JEL: H60 – General

JEL: H61 – Budget; Budget Systems

JEL: H62 – Deficit; Surplus

JEL: H63 - Debt; Debt Management; Sovereign Debt

JEL: H68 – Forecasts of Budgets, Deficits, and Debt

JEL: H69 – Other - ↑ JEL: H71 – State and Local Taxation, Subsidies, and Revenue

JEL: H72 – State and Local Budget and Expenditures

JEL: H73 – Interjurisdictional Differentials and Their Effects

JEL: H74 – State and Local Borrowing

JEL: H75 - State and Local Government: Health; Education; Welfare; Public Pensions

JEL: H76 - State and Local Government: Other Expenditure Categories

JEL: H77 - Intergovernmental Relations; Federalism; Secession - ↑ JEL: H80 – General

JEL: H81 – Governmental Loans, Loan guarantee, Credits, and Grants; Bailouts

JEL: H82 – Governmental Property

JEL: H83 – Public administration; Public Sector Accounting and Audits

JEL: H84 - Disaster Aid

JEL: H87 – International Fiscal Issues; International Public Goods - ↑ Doss, Daniel; Sumrall, William; McElreath, David; Jones, Don (2014). Economic and Financial Analysis for Criminal Justice Organizations (1st ed.). Boca Raton, Florida: CRC Press. p. 138. ISBN 978-1466592063.

- ↑ A.R. Prest and R. Turvey, 1965. "Cost-Benefit Analysis: A Survey" The Economic Journal, 75(300) pp. 683-735.

- ↑ Introduction to Benefit-Cost Analysis

References

- Atkinson, Anthony B., and Joseph E. Stiglitz, 1980. Lectures in Public Economics, McGraw-Hill

- Auerbach, Alan J., and Martin S. Feldstein, ed. Handbook of Public Economics. Elsevier.

- 1985, v. 1. Description and preview.

- 1987, v. 2. Description.

- 2002. v. 3. Description.

- 2007. v. 4. Description.

- Barr, Nicholas, 2004. Economics of the Welfare State, 4th ed., Oxford University Press.

- Buchanan, James M., [1967] 1987. Public Finance in Democratic Process: Fiscal Institutions and Individual Choice, UNC Press. Description, scrollable preview, and back cover.

- _____ and Musgrave, Richard A., 1999. Public Finance and Public Choice: Two Contrasting Visions of the State. MIT Press. Description and scrollable preview links.

- Coase, Ronald. "The Problem of Social Cost" Journal of Law and Economics Vol. 3 (Oct. 1960) 1-44

- Diamond, Peter A. and James A. Mirrlees. "Optimal Taxation and Public Production I: Production Efficiency" The American Economic Review Vol. 61 No. 1 (Mar. 1971) 8-27

- Diamond, Peter A. and James A. Mirrlees. "Optimal Taxation and Public Production II: Tax Rules" The American Economic Review Vol. 61 No. 3 (Jun. 1971) 261-278

- Drèze Jacques H., 1995. "Forty Years of Public Economics: A Personal Perspective," Journal of Economic Perspectives, 9(2), pp. 111-130.

- Dupuit, Jules. "On the Measurement of the Utility of Public Works" in Readings in Welfare Economics, ed. Kenneth J. Arrow and Tibor Scitovsky (1969)

- Haveman, Robert 1976. The Economics of the Public Sector.

- Kolm, Serge-Christophe, 1987. "public economics," The New Palgrave: A Dictionary of Economics, v. 3, pp. 1047–55.

- Feldstein, Martin S., and Robert P. Inman, ed., 1977. The Economics of Public Services. Palgrave Macmillan.

- Musgrave, Richard A., 1959. The Theory of Public Finance: A Study in Public Economy, McGraw-Hill. 1st-page reviews of J.M. Buchanan & C.S. Shoup.

- _____ and Alan T. Peacock, ed., [1958] 1994. Classics in the Theory of Public Finance, Palgrave Macmillan. Description and contents.

- Laffont, Jean-Jacques, 1988. Fundamentals of Public Economics, MIT Press. Description.

- Myles, Gareth D., 1995. Public Economics, Cambridge. Description and scroll to chapter-preview links.

- Oates, Wallace E., 1972. Fiscal Federalism, Harcourt Brace Jovanovich, Inc.

- Pigou, A.C. "Divergences Between Marginal Social Net Product and Marginal Private Net Product" in The Economics of Welfare, A.C. Pigou (1932)

- Ramsey, Frank P. "A Contribution to the Theory of Taxation" in Classics in the Theory of Public Finance, ed. R.A. Musgrave and A.T. Peacock (1958)

- Stigler, George J. and Paul A. Samuelson, 1963. "A Dialogue on the Proper Economic Role of the State." Selected Papers, No.7. Chicago: University of Chicago Graduate School of Business.

- Starrett, David A., 1988. Foundations of Public Economics, Cambridge. Description. Scroll to chapter-preview links.

- Stiglitz, Joseph E., 1994. 'Rethinking the Economic Role of the State: Publicly Provided Private Goods' Unpublished.

- _____, 1998. "The Role of Government in the Contemporary World," in Vito Tanzi and Ke-Young Chu, Income Distribution and High-Quality Growth, pp. 211-54.

- _____, 2000. Economics of the Public Sector, 3rd ed., Norton.

- Tinbergen, Jan, 1958. On the Theory of Economic Policy.

Further reading

- Arrow, Kenneth J. Social Choice and Individual Values. (1970)

- Atkinson, Anthony B. "On the Measurement of Inequality" Journal of Economic Theory 2 (1970) 244-263

- Auerbach, Alan J. and Laurence J. Kotlikoff. Dynamic Fiscal Policy. (1987)

- Boiteux, Marcel. "On the Management of Public Monopolies Subject to Budgetary Constraints" Journal of Economic Theory 3 (1971) 219-240

- Buchanan, James M. and Gordon Tullock. The Calculus of Consent: Logical Foundations of Constitutional Democracy. (2010)

- Corlett, W.J. and D.C. Hague. "Complementarity and the Excess Burden of Taxation" The Review of Economic Studies Vol. 21 No. 1 (1953–1954) 21-30

- Dalton, Hugh. "The Measurement of Inequality of Incomes" The Economics Journal Vol. 30, No. 119 (Sep. 1920) 348-361

- Edgeworth, F.Y. "The Pure Theory of Taxation" The Economic Journal Vol. 7 No. 25 (Mar. 1897) 46-70

- Feldstein, Martin. "Social Security, Induced Retirement, and Aggregate Capital Accumulation" The Journal of Political Economy Vol. 82 No. 5 (Sep.-Oct. 1974) 905-926

- Fisher, Irving. "Income in Theory and Income Taxation in Practice" Econometrica Vol. 5 No. 1 (Jan. 1937) 1-55

- Fisher, Irving. "The Double Taxation of Savings" The American Economic Review Vol. 29 No. 1 (Mar. 1939) 16-33

- Gini, Corrado. "Variability and Mutability" in Memorie di Metodologica Statistica, ed. E. Pizetti and T. Salvemini (1955)

- Harberger, Arnold. "The Incidence of the Corporation Income Tax" The Journal of Political Economy Vol. 70 No. 3 (Jun. 1962) 215-240

- Higgs, Robert (2008). "Government Growth". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Lihndahl, Erik. "Just Taxation: A Positive Solution" in Classics in the Theory of Public Finance, ed. R.A. Musgrave and A.T. Peacock (1958)

- Lorenz, M.O. "Methods of Measuring the Concentration of Wealth" American Statistical Association Vol. 9 No. 70 (Jun. 1905) 209-219

- Musgrave, Richard A. "A Multiple Theory of Budget Determination" (1957)

- Niskanen, William A. "The Peculiar Economics of Bureaucracy" The American Economic Review Vol. 58, No. 2 (May 1968) 293-305

- Niskanen, William A. Bureaucracy and Representative Government. (2007)

- Orshansky, Mollie. "Children of the Poor" Social Security Bulletin Vol. 26 No. 7 (July 1963)

- Orshansky, Mollie. "Counting the Poor: Another Look at the Poverty Profile" Social Security Bulletin Vol. 28 No. 1 (Jan. 1965)

- Samuelson, Paul. "The Pure Theory of Public Expenditure" Review of Economics and Statistics, XXXVI (1954), 387-89

- Seater, John J. (2008). "Government Debt and Deficits". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Tiebout, Charles M. "A Pure Theory of Local Expenditure" The Journal of Political Economy Vol. 64, No. 5 (Oct. 1956), 416-424

- Wicksell, Knut. "A New Principle of Just Taxation" in Classics in the Theory of Public Finance, ed. R.A. Musgrave and A.T. Peacock (1958)