Petroleum refining in the United States

Petroleum refining in the United States in 2013 produced 18.9 million barrels per day of refined petroleum products, more than any other country.[2] Although the US was the world's largest net importer of refined petroleum products as recently as 2008, the US became a net exporter in 2010, and in 2014 was the largest exporter and the largest net exporter of refined petroleum.[3] As of January 2015, there were 137 operating refineries in the US, distributed among 30 states.

Largest petroleum refining companies in the United States

| Rank | Corporation | Barrels/Day | No. of US Refineries | States |

|---|---|---|---|---|

| 1 | Valero Energy | 2,062,300 | 13 | CA, LA, OK, TN, TX |

| 2 | Marathon Petroleum | 1,794,000 | 7 | IL, KY, LA, MI, OH, TX |

| 3 | Exxon Mobil | 1,706,200 | 5 | IL, LA, MT, TX |

| 4 | Phillips 66 | 1,612,200 | 9 | CA, LA, MT, NJ, OK, TX, WA |

| 5 | Motiva | 1,075,700 | 3 | LA, TX |

| 6 | Chevron Corporation | 897.271 | 4 | CA, MS, UT |

| 7 | PBF Energy | 846,000 | 5 | CA, DE, LA, NJ, OH |

| 8 | Tesoro (+ proposed Western Refining merger)[4] | 831,030 (1,067,430) | 7 (10) | AK, CA, ND, UT, WA (NM, MN) |

| 9 | PDV | 761,240 | 3 | IL, LA, TX |

| 10 | BP | 651,000 | 3 | AK, IN, WA |

| 11 | Koch Industries | 560,000 | 2 | MN, TX |

| Total operable atmospheric crude oil distillation capacity as of 1 January 2016 adjusted for Torrance, CA[5] & Honolulu, HI[6] finalized sales. Source:[7] | ||||

Largest petroleum refineries in the United States

| Rank | Refinery | Barrels/Day | Owner | State |

|---|---|---|---|---|

| 1 | Port Arthur Refinery | 603,000 | Motiva Enterprises | TX |

| 2 | Baytown Refinery | 560,500 | Exxon Mobil | TX |

| 3 | Garyville Refinery | 522,000 | Marathon Petroleum | LA |

| 4 | Baton Rouge Refinery | 502,500 | Exxon Mobil | LA |

| 5 | Galveston Bay Refinery | 451,000 | Marathon Petroleum | TX |

| 6 | Lake Charles Refinery | 427,800 | PDV | LA |

| 7 | Whiting Refinery | 413,500 | BP | IN |

| 8 | Beaumont Refinery | 344,600 | Exxon Mobil | TX |

| 9 | Wood River Refinery | 336,000 | WRB Refining | IL |

| 10/11 | Port Arthur Refinery | 335,000 | Valero | TX |

| 10/11 | Philadelphia Refinery | 335,000 | The Carlyle Group | PA |

| Total operable atmospheric crude oil distillation capacity as of 1 January 2015. Source:[8] | ||||

History

The first known US petroleum refiner was Samuel Kier of Pittsburgh, who in the 1850s produced an illuminating oil for miners' lamps.

American petroleum refining largely grew out of oil shale refining. When the Drake Well started producing in in 1859, the oil shale industry was growing rapidly, and establishing refineries near cannel coal deposits along the Ohio River Valley. As oil production increased, the oil shale refiners discovered that their refining process worked just as well with petroleum, and that petroleum was a cheaper raw material than shale oil. In 1861, the existing oil shale refiners switched to petroleum feedstock, and the oil shale mines shut down.

In the 1800s, the principal refined product was kerosene for illuminating oil. The heaviest fraction was used as lubricating oil. A market developed for fuel oil as it was discovered that petroleum was superior to coal in powering the large engines of ships and railroad locomotives.

The popularity of the automobile in the early 1900s created a mass market for gasoline, and a shortage soon developed of the lighter gasoline fractions of crude oil. The shortage was solved by the invention of the catalytic cracker, which broke long hydrocarbon chains into smaller molecules.

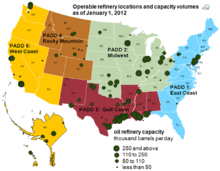

Geography

Most large refineries are near navigable waterways, especially seaports or Great Lakes ports. The single largest concentration of refineries is along the Gulf Coast.[9] Although there are refineries in 30 states, just three states dominate US refining: Texas (47 operating refineries), Louisiana (19), and California (18). As of January 2015, these three states contain 45% of all US refineries and 59% of all US refining capacity.[10]

Products

The three largest-volume products of US refineries are gasoline, fuel oil (including diesel fuel and home heating oil), and aviation fuel, which together make up more than 84 percent of output.[11]

Byproduct sulfur

Petroleum refineries recover elemental sulfur as a byproduct. In 2012, US oil refineries recovered 7.4 million metric tons of sulfur, worth about $915 million, and amounting to 88% of the elemental sulfur produced in the US.[12]

International trade

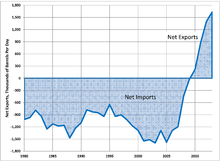

The United States was for decades, through 2008, the world's largest net importer of refined petroleum products. But the situation quickly changed in 2008 as American refineries became much more cost-competitive due to large increases in US production of oil, natural gas, and natural gas liquids. The US became a net exporter of refined petroleum in 2010, and since 2013 has been the world's largest net exporter of refined petroleum. In 2014, the US exported 3.83 million barrels per day and imported 1.35 million barrels per day of refined petroleum, for net exports of 2.48 million barrels per day.[13]

The competitive advantage of US refiners has been attributed to the lower price of American crude oil, as reflected by the Oklahoma-based index price West Texas Intermediate, versus the more expensive European-based index price Brent Crude. Due to the great surge in American production of oil, natural gas, and natural gas liquids since 2008, those products have been cheaper in the North American market than worldwide, giving American refiners a major cost advantage.[14] The discount on US crude is partially attributed to the long-standing federal ban on exports of American crude oil.[15]

European Union refiners have been hard-hit by the growth in US exports. They lost much of their previous gasoline exports to the US, and also market share in the worldwide market to the newly competitive US refineries. In addition, US refineries have increasingly exported petroleum products to the EU. In 2008, US exports of gas oil (home heating fuel) surged to a 31% market share in the EU, up from 5% the previous year; in 2011, US imports held a 37% market share of gasoil in the EU.[16] There has been discussion that EU refineries would have to shut down without government intervention. [17]

References

- ↑ "U.S. Energy Information Administration: Top 10 U.S. Refineries Operable Capacity". Retrieved 2015-01-26.

- ↑ OPEC, Statistical Bulletin, 2014

- ↑ OPEC, Annual Statistical Bulletin, 2015.

- ↑ "Tesoro, Western Refining to merge". www.ogj.com. Retrieved 2016-11-30.

- ↑ "PBF Energy Completes Acquisition of the Torrance Refinery and Related Logistics Assets". investors.pbfenergy.com. Retrieved 2016-11-30.

- ↑ "Island Energy finalizes deal for Chevron Hawaii refinery, downstream assets". www.ogj.com. Retrieved 2016-11-30.

- ↑ US Energy Information Administration, Table 5, 2015.

- ↑ US Energy Information Administration, Table 5, 2015.

- ↑ US Energy Information Administration, Much of the country’s refinery capacity is concentrated along the Gulf Coast, 19 July, 2012.

- ↑ US Energy Information Administration, Refining capacity by state.

- ↑ US Energy Information Administration, Refinery Yield accessed 26 July 2015.

- ↑ Lori E. Apodaca, Sulfur, US Geological Survey, 2012 Minerals Yearbook, Feb. 2015.

- ↑ OPEC, Data Download, Tables 5.4 and 5.7, 2014.

- ↑ Nicolas Sakelaris, "How the shale boom translates into big profits for US refineries," Dallas Business Journal, 5 June 2014.

- ↑ Ed Crooks, "US oil refiners face battle to prolong halcyon days," Financial Times, 17 Aug. 2014.

- ↑ Chris Beddoes, "Competitiveness of European refining," 6th Oil Forum of the Energy Community, 30 Sept. 2014.

- ↑ Tara Patel, "French refineries at risk as demand weakens, industry lobby says," Bloomberg, 10 Mar. 2015.