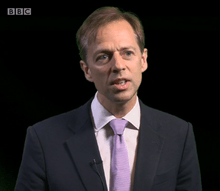

Huw van Steenis

Huw van Steenis (born 25 September 1969) is Global Head of Strategy at Schroders, a British multinational asset management company. He joined Schroders in October 2016,[1][2] having previously worked as Global Coordinator Banks and Diversified Financials at investment bank Morgan Stanley. Notable for his bearish forecasts prior to the global financial crisis and Eurozone crisis, and views on the reshaping of the investment industry.[3][4]

Education

Van Steenis studied at Trinity College, Oxford where he obtained an MA in Politics, Philosophy and Economics. In 1994 he went to INSEAD Business School where he obtained an MBA.[5]

Career

Van Steenis is a member of the World Economic Forum’s Global Agenda Council on Banking.[6] He has commented favourably on several UK government policy initiatives,[7] including the UK housing scheme Help to Buy[8] with his colleague Charles Goodhart[9][10]

Asset Management Barbell In 2004 he coined the term the “Asset Management Barbell”,[11][12][13] “which predicted the predicted the bulk of assets would be invested in low-cost passive or index-hugging products such as ETFs, with a small but significant amount in high margin"[14] and “high alpha products, with intensifying pressure on the middle ground of more conventional asset management”[15][16][17]

Balkanisation of Banking Markets In 2012, he coined the term Balkanisation of Banking Markets[18] to describe the breakdown in cross-border banking lending as regulators look to put up barriers to protect domestic markets and the policy challenge to rebuild a single market in lending within the Eurozone.[19][20][21]

In 2015, van Steenis joined the Board of English National Opera.[22]

Awards and Recognition

In 2009, van Steenis was named 'European Banker of the Quarter' for Q1 2009 by The Wall Street Journal's Financial News for his work on the banking crisis and policy response. The judges describing him as "one of the most well regarded and influential voices commenting on issues facing the industry … who has helped to position the US bank as an authority on the European policy response to the crisis".[23] Anthony Hilton, City Editor, Evening Standard called him as "one of the most authoritative banking analysts in Europe" [24] His awards include being voted the number one equity research analyst for Banks and Diversified Financials twelve times in institutional investor polls.[25] He has won a number of forecasting awards including European "Stock Picker of the Year" for Banks and Financials in Reuter’s Starmine twice.[26] In 2008, van Steenis was tipped as Rising Star Under 40 by Wall Street Journal's Financial News for the third time. The judges said: “He was early to spot the implications of the funding crisis and warned investors to steer clear of single-A banks, forecast the majority of the sectors rights issues and dividend cuts and the financials portfolio he runs for Morgan Stanley has outperformed the sector by over 25% for the year”[27]

Personal life

Van Steenis is married to Camilla Cavendish, Baroness Cavendish of Little Venice.[28] He is the great nephew of botanist Cornelis Gijsbert Gerrit Jan van Steenis.

External links

- ECB QE video

- European bank stress tests

- Bank sector 'Rehabilitated' video

- Threat of a European Banking Crisis Is Receding video

- Europe needs a new kind of union video

- Huw van Steenis and Christian Edelmann interview

References

- ↑ "Schroders appoints Global Head of Strategy". Retrieved 11 November 2016.

- ↑ "Morgan Stanley's van Steenis latest to flee for asset management". www.ft.com. Financial Times. Retrieved 11 November 2016.

- ↑ "Interview: Huw van Steenis". London Business School. Retrieved 11 November 2016.

- ↑ "The fund managers' new faith". This is Money. Retrieved 11 November 2016.

- ↑ Who's Who in the City, 2011, Caritas Data

- ↑ "Global Agenda Councils". Retrieved 14 July 2016.

- ↑ "Lords Hansard text for 24 Oct 2013 (pt 0001)". Retrieved 14 July 2016.

- ↑ "Anthony Hilton: Help to Buy deserves to be permanent". 12 March 2014. Retrieved 14 July 2016.

- ↑ Steenis, Huw van; Goodhart, Charles (15 September 2013). "Make Help to Buy a permanent private sector scheme". Retrieved 14 July 2016 – via Financial Times.

- ↑ "How to lift Britain - The Sunday Times". Retrieved 14 July 2016.

- ↑ "No place for tradition in brave new world - FT.com". ft.com. Retrieved 28 July 2016.

- ↑ "Clue to trends found in M&A activity - FT.com". ft.com. Retrieved 28 July 2016.

- ↑ Skypala, Pauline (7 September 2008). "The barbell rings true for traditionals". Retrieved 14 July 2016 – via Financial Times.

- ↑ Grene, Sophia. "Who is tapping into the axes of growth?". Retrieved 14 July 2016 – via Financial Times.

- ↑ "Semper Fi". Retrieved 14 July 2016 – via The Economist.

- ↑ http://www.theinvestmentassociation.org/assets/files/research/2014/20140909-IMA2013-2014-AMS-chapter2.pdf

- ↑ Grene, Sophia. "Who is tapping into the axes of growth?". Retrieved 14 July 2016 – via Financial Times.

- ↑ "Euromoney Magazine". Retrieved 14 July 2016.

- ↑ Schäfer, Daniel (11 April 2013). "Rules threaten global banks, reports say". Retrieved 14 July 2016 – via Financial Times.

- ↑ Jenkins, Patrick. "Banking union must halt Balkanisation". Retrieved 14 July 2016 – via Financial Times.

- ↑ Atkins, Ralph (3 September 2012). "Eurozone: Convergence in reverse". Retrieved 14 July 2016 – via Financial Times.

- ↑ "Huw van Steenis: high note". Financial Times. Retrieved 11 November 2016.

- ↑ "Van Steenis builds reputation as policy insider". efinancialnews.com. Retrieved 28 July 2016.

- ↑ "Lend an ear to small firms' bank woes". 15 November 2011. Retrieved 14 July 2016.

- ↑ Extel. "Extel". Retrieved 14 July 2016.

- ↑ http://excellence.thomsonreuters.com/awards/starmine/analyst-awards/2006/pan-europe

- ↑ "Sign in or Register - Financial News". Retrieved 14 July 2016.

- ↑ Dorling, Danny (5 March 2015). "Danny Dorling on £6K fees: the 1% won't feel a thing". Times Higher Education. Retrieved 26 May 2015.