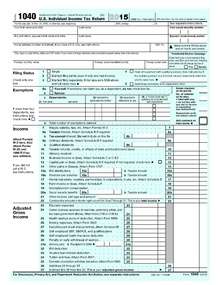

Form 1040

Form 1040 (officially, the "U.S. Individual Income Tax Return") is one of three IRS tax forms (see variants section for explanations of each) used for personal (individual) federal income tax returns filed with the Internal Revenue Service (IRS) by United States residents for tax purposes.

Income tax returns for individual calendar year taxpayers are due by Tax Day, which is usually April 15 of the next year, except when April 15 falls on a Saturday, Sunday, or a legal holiday. In those circumstances, the returns are due on the next business day. An automatic extension until October 15 to file Form 1040 can be obtained by filing Form 4868.

Form 1040 consists of two full pages (79 lines in total) not counting attachments.[1] The first page collects information about the taxpayer(s), dependents, income items, and adjustments to income. In particular, the taxpayer specifies his/her filing status and personal exemptions on this page. The second page calculates the allowable deductions and credits, tax due given the income figure, and applies funds already withheld from wages or estimated payments made towards the tax liability. At the top of the first page is the presidential election campaign fund checkoff, which allows individuals to designate that the federal government give $3 of the tax it receives to the Presidential election campaign fund. The instructions booklet for Form 1040 is 104 pages as of 2014.[2]

Altogether, over 147 million returns were filed for Form 1040 and its variants in the year 2014,[3] 80% of which were filed electronically.[2]:4

Filing requirements

Who must file?

Form 1040 (or a variant thereof) is the main tax form filed by individuals who are deemed residents of the United States for tax purposes. The corresponding main form filed by businesses is Form 1120, also called the U.S. Corporation Income Tax Return.[4]

An individual is considered a resident of the United States for tax purposes if he or she is a citizen of the United States or a resident alien of the United States for tax purposes.[2]:6 An individual is a resident alien of the United States if he or she passes either the Substantial Presence Test or the Green Card Test, although there are also some other cases; individuals who have taxable income in the United States but fail the criteria for being resident aliens must file as nonresident aliens for tax purposes.[5]:3 While residents of the United States for tax purposes file Forms 1040, 1040A, or 1040EZ, nonresident aliens must file Form 1040NR or 1040NR-EZ.[6] There is also a "dual status alien" for aliens whose status changed during the year.

Resident aliens of the United States for tax purposes must generally file if their income crosses a threshold where their taxable income is likely to be positive, but there are many other cases where it may be legally desirable to file. For instance, even if not required, individuals can file a return in order to receive a refund on withheld income or to receive certain credits (e.g. earned income tax credit).[2]:6

Filing modalities

The form may be filed either by paper or online.

Paper filing

Paper filing is the universally accepted filing method. Form 1040, along with its variants, schedules, and instructions, can be downloaded as PDFs from the Internal Revenue Service website.[7] Finalized versions of the forms for the tax year (which in the US is the same as the calendar year) are released near the end of January of the following year.

Paper forms can be filled and saved electronically using a compatible PDF reader, and then printed. This way, it is easy to keep electronic copies of one's filled forms despite filing by paper. Alternatively, they can be printed out and filled by hand. A combination of the approaches may also be used, with some content filled in electronically and additional content written in by hand. As a general rule, where possible, it makes sense to fill electronically, but in some cases filling by hand may be necessary (for instance, if additional notes of explanation need to be added, or the font used for electronic filling is too large to fit the information in the space provided.

The only parts of the form that cannot be filled electronically are the signature lines.

The paper Form 1040, along with all relevant schedules and additional forms, must be sent in a single packet by mail or courier to an IRS address determined by the US state the taxpayer is filing from and whether or not a payment is enclosed; the addresses for the three forms (1040, 1040A, 1040EZ) are identical.[8]

The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.[9][10]

Electronic filing

The IRS allows US residents for tax purposes to file electronically in three ways:[11]

- Those with incomes of $62,000 or less may file electronically using IRS Free File, a free e-filing tool (there are some other conditions necessary to be eligible for free filing; in particular, some kinds of income and deductions cannot be handled by free filing).[12]

- It is possible to prepare one's tax return using a tax compliance software approved by the IRS and have the software file the return electronically.

- One can use a tax professional who has been accepted by the IRS for electronic filing.

Many paid tax preparers are required to file individual tax returns electronically, and most tax compliance softwares file electronically on the taxpayer's behalf. Even tax preparers who are not so required, must file Form 8948 if they choose paper filing, providing an explanation for why they are not filing electronically.[13]

Comparison

If one is not eligible for IRS Free File, it might cost hundreds of dollars to file electronically, whereas paper filing has no costs beyond those of printing and mailing. Furthermore, the available existing electronic filing options may not offer sufficient flexibility with respect to arranging one's tax return, adding attachments, or putting written notes of explanation that can help preempt IRS questions. In addition, electronic filing makes one's tax return more likely to be audited because it is already in a format accessible to the IRS, whereas of paper returns, only 40% are transcribed, so that the remaining are not even in the running for being audited. For these reasons, law resource NOLO as well as Forbes argue that the more complicated one's tax return, the better it is to file on paper.[14][15] Filing electronically also exposes the taxpayer's data to the risk of accidental loss or identity theft.[16][17]

Signature requirement

Form 1040 must be signed and dated in order to be considered valid. If filing jointly with a spouse, both must sign and date.[18] If a return is submitted electronically, individuals must use either a Self-Select PIN or Practitioner PIN.[19]

Substitute return

If an individual decides not to file a return, the IRS may (after it has sent several reminders) file a substitute return.[20][21][22]

Variants

In addition to the standard Form 1040, there are also two variants: the 1040A and 1040EZ ("easy"). There is also the 1040X, which is used to make amendments to the 1040. Form 1040 and 1040A use the same line numbering up to and including line 9; Form 1040EZ uses completely different line numbering. Line numbering is important to keep in mind since many state income tax returns reference line numbers on the 1040.

1040A

The 1040A (nicknamed the "short form") is a shorter version of the standard Form 1040. It is limited to taxpayers with taxable income below $100,000 who take the standard deduction instead of itemizing deductions. The 1040 can always be used instead of the 1040A, but the 1040A can only be used when the restrictions apply.[23]

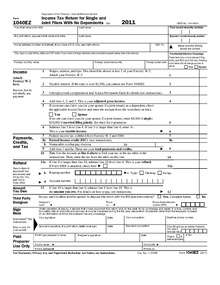

1040EZ

The 1040EZ (officially called "Income Tax Return for Single and Joint Filers with No Dependents", but nicknamed the "easy form") is a simplified, six-section version of the 1040. Its use is limited to taxpayers with taxable income below $100,000 who take the standard deduction instead of itemizing deductions.[24] The 1040 or 1040A can always be used in place of the 1040EZ, but not the other way around.

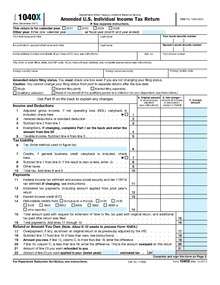

1040X

The 1040X (officially, the "Amended U.S. Individual Tax Return") is used to make corrections on Form 1040, Form 1040A, and Form 1040EZ tax returns that have been previously filed.

Accompanying payments

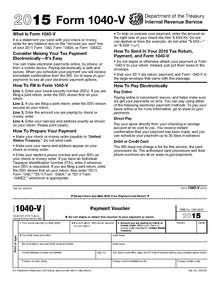

Form 1040-V

The 1040-V (officially, the "Payment Voucher for Form 1040") is used as an optional payment voucher to be sent in along with a payment for any balance due on the "Amount you owe" line of the 1040.[9]

The form is entirely optional. The IRS will accept payment without the 1040V form. However including the 1040-V allows the IRS to process payments more efficiently.[25]

Form 1040-V and any accompanying payment should be included in the same packet as the tax return, but should not be stapled or paperclipped along with the tax return, since it is processed separately.[9][10]

Schedules and extra forms

Form 1040 has 14 attachments, called "schedules", which may need to be filed depending on the taxpayer. For 2009 and 2010 there was an additional form, Schedule M, due to the "Making Work Pay" provision of the American Recovery and Reinvestment Act of 2009 ("the stimulus").

| Type | Explanation | Lines where schedule is referenced or needed in Form 1040 |

|---|---|---|

| Schedule A | Itemizes allowable deductions against income; instead of filling out Schedule A, taxpayers may choose to take a standard deduction of between $6,300 and $12,600 (for tax year 2015), depending on age, filing status, and whether the taxpayer and/or spouse is blind. | 40 |

| Schedule B | Enumerates interest and/or dividend income, and is required if either interest or dividends received during the tax year exceed $1,500 from all sources or if the filer had certain foreign accounts. | 8a, 9a |

| Schedule C | Lists income and expenses related to self-employment, and is used by sole proprietors. | 12 |

| Schedule D | Is used to compute capital gains and losses incurred during the tax year. | 13 |

| Schedule E | Is used to report income and expenses arising from the rental of real property, royalties, or from pass-through entities (like trusts, estates, partnerships, or S corporations). | 17 |

| Schedule EIC | Is used to document a taxpayer's eligibility for the Earned Income Credit. | 66a |

| Schedule F | Is used to report income and expenses related to farming. | 18 |

| Schedule H | Is used to report taxes owed due to the employment of household help. | 60a |

| Schedule J | Is used when averaging farm income over a period of three years. | 44 |

| Schedule L | (Until 2010) was used to figure an increased standard deduction in certain cases.[26] | N/A |

| Schedule M | (2009 and 2010) was used to claim the Making Work Pay tax credit (6.2% earned income credit, up to $400).[27] | N/A |

| Schedule R | Is used to calculate the Credit for the Elderly or the Disabled. | 54 |

| Schedule SE | Is used to calculate the self-employment tax owed on income from self-employment (such as on a Schedule C or Schedule F, or in a partnership). | 57 |

| Schedule 8812 | Is used to calculate the Child Tax Credit. | 52, 67 |

In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Act—the premium tax credit and the individual mandate.[28]

In most situations, other Internal Revenue Service or Social Security Administration forms such as Form W-2 must be attached to the Form 1040, in addition to the Form 1040 schedules. There are over 100 other specialized forms that may need to be completed along with Schedules and the Form 1040.[29] However, Form 1099 need not be attached if no tax was withheld.[30] In general, employer-sent forms are used to substantiate claims of withholding, so only forms that involve withholding need to be attached.

Estimated payments and withholding

For most individuals, withholding is the main way through which taxes are paid. However, income that is not subject to withholding must be estimated using Form 1040-ES. (It may be possible to avoid filing Form 1040-ES by increasing one's withholding and instead filing a Form W-4.)[31]

Estimated payments can be made using the Electronic Federal Tax Payment System.[32][33]

Payments, refunds, and penalties

There is a three-year limit to when individuals can claim a tax refund. However, payments that are due must be paid immediately.[34]

In addition it is possible to apply one's refunds to next year's taxes[35] and also to change one's mind later.[36]

There is a penalty for not filing a tax return by April 15 that depends on whether the individual got a filing extension and the amount of unpaid taxes. However, since the maximum penalty is 25% of unpaid taxes, if an individual has paid all their taxes, there is no penalty for not filing.[34][37]

In addition to making sure that one pays one's taxes for the year by Tax Day, it is also important to make sure that one has paid partial taxes throughout the tax year in the form of estimated tax payments of employer tax withholding. If one has not done so, then a tax penalty may be assessed.[38] The minimum amount of estimated taxes that need to be paid to avoid penalties depends on a variety of factors, including one's income in the tax year in question as well as one's income in the previous year (in general, if one pays 90% of the current year's tax liability or 100% of the previous year's tax liability during the tax year, one is not subject to estimated tax penalty even if this year's taxes are higher, but there are some caveats to that rule).[39][40] Employer withholding is also treated differently from estimated tax payment, in that for the latter, the time of the year when the payment was made matters, whereas for the former, all that matters is how much has been withheld as of the end of the year (though there are other restrictions on how one can adjust one's withholding pattern that need to be enforced by the employer).[39][41]

When filing Form 1040, the penalty for failing to pay estimated taxes must be included on the form (on line 79) and included in the total on line 78 (if a net payment is due). The taxpayer is not required to compute other interest and penalties (such as penalty for late filing or late payment of taxes). If the taxpayer does choose to compute these, the computed penalty can be listed on the bottom margin of page 2 of the form, but should not be included on the amount due line (line 78).[42][43]

Relationship with state tax returns

Each state has separate tax codes in addition to federal taxes. Form 1040 is only used for federal taxes, and state taxes should be filed separately based off the individual state's form. Some states do not have any income tax.[44] Although state taxes are filed separately, many state tax returns will reference items from Form 1040. For example California's 540 Resident Income Tax form makes a reference to Form 1040's line 37 in line 13.[45]

Certain tax filing software, such as TurboTax, will simultaneously file state tax returns using information filled in on the 1040 form.[46]

The Federal government allows individuals to deduct their state income tax or their state sales tax from their federal tax through Schedule A of Form 1040, but not both.[47] In addition to deducting either income tax or sales tax, an individual can further deduct any state real estate taxes or private property taxes.[48]

OMB control number controversy

One argument used by tax protesters against the legitimacy of the 1040 Form is the OMB Control Number or the Paperwork Reduction Act argument. Tax protesters contend that Form 1040 does not contain an "OMB Control Number" which is issued by the U.S. Office of Management and Budget under the Paperwork Reduction Act.

The relevant clauses of the Paperwork Reduction Act state that:

- § 1320.6 Public protection.

- (a) Notwithstanding any other provision of law, no person shall be subject to any penalty for failing to comply with a collection of information that is subject to the requirements of this part if:

- (1) The collection of information does not display, in accordance with §1320.3(f) and §1320.5(b)(1), a currently valid OMB control number assigned by the Director in accordance with the Act…

- (e) The protection provided by paragraph (a) of this section does not preclude the imposition of a penalty on a person for failing to comply with a collection of information that is imposed on the person by statute—e.g., 26 U.S.C. §6011(a) (statutory requirement for person to file a tax return)…[49]

The Courts have responded to the OMB Control Number arguments with the following arguments. 1) Form 1040, U.S. Individual Income Tax Return has contained the OMB Control number since 1981.[50] 2) As ruled in a number of cases, the absence of an OMB Control number does not eliminate the legal obligation to file or pay taxes.

Cases involving the OMB Control Number Argument include:

- United States v. Wunder

The United States Court of Appeals for the Sixth Circuit argues that the provisions on the Paperwork Reduction Act are not relevant as the act applies only to information requests made after December 31, 1981 and tax returns starting from 1981 contained an OMB Control Number.[51]

- United States v. Patridge

The United States Court of Appeals for the Seventh Circuit rejected the convicted taxpayer's OMB control number argument by stating "Finally, we have no doubt that the IRS has complied with the Paperwork Reduction Act. Form 1040 bears a control number from OMB, as do the other forms the IRS commonly distributes to taxpayers. That this number has been constant since 1981 does not imply that OMB has shirked its duty." [52]

- United States v. Lawrence

In this Case, IRS agents who had calculated Mr. Lawrence's tax liability had made an error and it was discovered that Mr. Lawrence owed less taxes than originally determined. Lawrence asked the trial court to order the government to reimburse him for his legal fees, to which the trial court ruled against him. He appealed to the United States Court of Appeals for the Seventh Circuit, contending that the government's conduct against him had been "vexatious, frivolous, or in bad faith." and also raising the OMB Control Number Argument.

The United States Court of Appeals for the Seventh Circuit rejected the OMB argument stating that

- "According to Lawrence, the Paperwork Reduction Act of 1995 (PRA) required the Internal Revenue Service to display valid Office of Management and Budget (OMB) numbers on its Form 1040…. Lawrence argues that the PRA by its terms prohibits the government from imposing a criminal penalty upon a citizen for the failure to complete a form where the information request at issue does not comply with the PRA... Yet Lawrence conceded at oral argument that no case from this circuit establishes such a proposition, and in fact Lawrence cites no caselaw from any jurisdiction that so holds. In contrast, the government referenced numerous cases supporting its position that the PRA does not present a defense to a criminal action for failure to file income taxes." [53]

History

Original form structure and tax rates

The first Form 1040 was published for use for the tax years 1913, 1914, and 1915.[54] For 1913, taxes applied only from March 1 to December 31.[54] The original Form 1040, available on the IRS website as well as elsewhere, is three pages[55] and 31 lines long, with the first page focused on computing one's income tax, the second page focused on more detailed documentation of one's income and the third page describing deductions and including a signature area. There is an additional page of instructions.[56][57][58] The main rules were:

- The taxable income was calculated starting from gross income, subtracting business-related expenses to get net income, and then subtracting specific exemptions (usually $3,000 or $4,000). In other words, people with net incomes below $3,000 would have to pay no income tax at all. The inflation calculator used by the Bureau of Labor Statistics estimates the corresponding amount in 2015 dollars as $71,920.[58][59]

- The base income tax rate on taxable income was 1%.

- High earners had to pay additional taxes. The first high-earning tax bracket, $20,000–$50,000, has an additional tax of 1% on the part of net income above $20,000. Thus, somebody with a taxable income of $50,000 (over a million dollars in 2015 dollars according to the BLS)[59] would pay a total of $800 (1% of $50,000 + 1% of $(50,000 − 20,000)) in federal income tax. At the time (when the United States as a whole was much poorer) these higher taxes applied to fewer than 0.5% of the residents of the United States.[60]

Just over 350,000 forms were filed in 1914 and all were audited.[58]

Subsequent changes

For 1916, Form 1040 was converted to an annual form (i.e., updated each year with the new tax year printed on the form).[61] Initially, the IRS mailed tax booklets (Form 1040, instructions, and most common attachments) to all households. As alternative delivery methods (CPA/Attorneys, Internet forms) increased in popularity, the IRS sent fewer packets via mail. In 2009 this practice was discontinued.

With the Current Tax Payment Act of 1943, income tax withholding was introduced. The Individual Income Tax Act of 1944 created standard deductions on the 1040.[62]

In 1954 the tax return deadline was changed to April 15.[62]

Form 1040A was introduced in 1941 to simplify the filing process.[63]

Form 1040EZ was introduced by the Internal Revenue Service for the 1982 tax year. The title of the 1982 form was "Income Tax Return for Single filers with no dependents."

Electronic filing was introduced in a limited form in 1986, with the passage of the Tax Reform Act of 1986, and starting 1992, taxpayers who owed money were allowed to file electronically.[62] The Electronic Federal Tax Payment System, jointly managed by the IRS and Financial Management Service, started in 1996 and allowed people to make estimated payments.[32][62]

Changes to complexity and tax rates

The complexity and compliance burden of the form and its associated instructions have increased considerably since 1913. The National Taxpayers Union has documented the steady increase in complexity from a 34-line form in 1935 to a 79-line form in 2014,[64] while Quartz created an animated GIF showing the gradual changes to the structure and complexity of the form.[65] The NTU table is below:

| Tax year | Lines, Form 1040 | Pages, Form 1040 | Pages, Form 1040 Instruction Booklet |

|---|---|---|---|

| 2014 | 79 | 2 | 209 |

| 2013 | 77 | 2 | 206 |

| 2012 | 77 | 2 | 214 |

| 2011 | 77 | 2 | 189 |

| 2010 | 77 | 2 | 179 |

| 2005 | 76 | 2 | 142 |

| 2000 | 70 | 2 | 117 |

| 1995 | 66 | 2 | 84 |

| 1985 | 68 | 2 | 52 |

| 1975 | 67 | 2 | 39 |

| 1965 | 54 | 2 | 17 |

| 1955 | 28 | 2 | 16 |

| 1945 | 24 | 2 | 4 |

| 1935 | 34 | 1 | 2 |

The number of pages in the federal tax law grew from 400 in 1913 to over 72,000 in 2011.[66] The increase in complexity can be attributed to an increase in the number and range of activities being taxed, an increase in the number of exemptions, credits, and deductions available, an increase in the subtlety of the rules governing taxation and the edge cases explicitly spelled out based on historical experience, and an increase in the base of taxpayers making it necessary to offer longer, more explicit instructions for less sophisticated taxpayers.[64] As an example, whereas the initial versions of Form 1040 came only with a rate schedule included in the tax form itself, the IRS now publishes a complete tax table for taxable income up to $100,000 so that people can directly look up their tax liability from their taxable income without having to do complicated arithmetic calculations based on the rate schedule.[67] The IRS still publishes its rate schedule so that people can quickly compute their approximate tax liability, and lets people with incomes of over $100,000 compute their taxes directly using the Tax Computation Worksheet.[68]

In addition to an increase in the complexity of the form, the tax rates have also increased, though the increase in tax rates has not been steady (with huge upswings and downswings) in contrast with the steady increase in tax complexity.[69]

Cost of filing

For tax return preparation, Americans spent roughly 20% of the amount collected in taxes (estimating the compliance costs and efficiency costs is difficult because neither the government nor taxpayers maintain regular accounts of these costs).[70][71] As of 2013, there were more tax preparers in the US (1.2 million) than there were law enforcement officers (765 thousand) and firefighters (310,400) combined.[66]

In 2008, 57.8% of tax returns were filed with assistance from paid tax preparers,[72] compared to about 20% of taxpayers employing a paid preparer in the 1950s.[73]:11

Analogs in other countries

In the United Kingdom, various returns such as the SA100 must be filed (see Tax return (United Kingdom) for more).

In Japan, most people do not need to file a tax return due to income withholding.[74]

See also

References

- ↑ "Form 1040 (2014)" (PDF). Internal Revenue Service. Retrieved December 28, 2015.

- 1 2 3 4 "1040 Instructions 2014" (PDF). Internal Revenue Service.

- ↑ "2015 Tax Statistics" (PDF). Internal Revenue Service.

- ↑ "Form 1120, U.S. Corporation Income Tax Return" (PDF). Retrieved January 1, 2016.

- ↑ "U.S. Tax Guide for Aliens For use in preparing 2014 Returns" (PDF). Internal Revenue Service.

- ↑ "Aliens - Which Form to File". Internal Revenue Service. Retrieved December 31, 2015.

- ↑ "Form 1040, U.S. Individual Income Tax Return". IRS.

- ↑ "Where to File Addresses for Taxpayers and Tax Professionals". Internal Revenue Service. Retrieved January 1, 2016.

- 1 2 3 "Form 1040-V, Payment Voucher for Form 1040". Internal Revenue Service. Retrieved June 18, 2015.

- 1 2 "When filing by mail to the IRS, should I staple or paperclip my tax return?". Quora. Retrieved June 29, 2016.

- ↑ "E-File Options for Individuals". Internal Revenue Service. Retrieved January 1, 2016.

- ↑ "Free File: Do Your Federal Taxes for Free". Internal Revenue Service. Retrieved January 1, 2016.

- ↑ "Form 8948, Preparer Explanation for Not Filing Electronically". Internal Revenue Service. Retrieved January 7, 2015.

- ↑ Fishman, Stephen (October 1, 2012). "Should You File Your Taxes Electronically? Not necessarily. There are some reasons you may want to stick to the old fashioned way.". NOLO. Retrieved January 1, 2016.

- ↑ Wood, Robert (March 15, 2011). "Paper Or E-File Your IRS Return?". Forbes. Retrieved January 1, 2016.

- ↑ "The Internal Revenue Service Is Not Adequately Protecting Taxpayer Data on Laptop Computers and Other Portable Electronic Media Devices" (PDF). Treasury.gov. TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION. 23 March 2007. Retrieved 2 August 2016.

IRS employees reported the loss or theft of at least 490 computers between January 2, 2003, and June 13, 2006 ... we conducted a separate test on 100 laptop computers currently in use by employees and determined 44 laptop computers contained unencrypted sensitive data, including taxpayer data and employee personnel data

- ↑ Anderson, Nate (6 April 2007). "Inspectors: IRS lost 490 laptops, many with unencrypted data". Ars Technica. Retrieved 2 August 2016.

- ↑ "Taxpayer Signature". Internal Revenue Service. Retrieved January 1, 2016.

- ↑ "Signing an Electronic Tax Return". Internal Revenue Service. November 6, 2014. Retrieved January 1, 2016.

- ↑ Delafuente, Charles (February 11, 2012). "If You Don't File, Beware the Ghost Return". The New York Times. Retrieved January 1, 2016.

- ↑ Morrow, Stephanie (September 1, 2009). "What Are The Penalties For Not Filing Taxes?". LegalZoom. Retrieved January 1, 2016.

- ↑ "If you don't file a tax return, when will the IRS file a "substitute return"?". Personal Finance & Money Stack Exchange. Retrieved July 1, 2016.

- ↑ "What is the IRS 1040A Form?". TurboTax. Retrieved December 31, 2015.

- ↑ "What's the difference between IRS Forms 1040EZ and 1040A?". Investopedia. Retrieved December 31, 2015.

- ↑ "What is IRS Form 1040-V?". TurboTax. Retrieved June 18, 2015.

- ↑ "Schedule L and Schedule M are gone". Bankrate.com. Retrieved 2013-03-10.

- ↑ Schedule M, (Instructions)

- ↑ Ashlea Ebeling (4 November 2014). "IRS Commissioner Predicts Miserable 2015 Tax Filing Season". Forbes.

- ↑ "Forms & Attachments Listing 1040/1040SSPR/1040-A/1040-EZ" (PDF). Internal Revenue Service. September 5, 2014. Retrieved December 31, 2015.

- ↑ Smith, Naomi. "Do You Need to Attach 1099 Forms to a Federal Tax Return?". Retrieved January 1, 2015.

- ↑ "Form 1040-ES 2015: Estimated Tax for Individuals" (PDF). Internal Revenue Service.

- 1 2 "Welcome to EFTPS - Help & Information". Electronic Federal Tax Payment System. Retrieved April 14, 2014.

- ↑ "Frequently asked questions about EFTPS". Bethpage Federal Credit Union. Retrieved April 14, 2014.

- 1 2 "IRS Penalties for Not Filing a Tax Return or Not Paying Taxes Owed". efile.com. Retrieved December 31, 2015.

- ↑ "How do I apply my refund to next year's taxes?". TurboTax. Retrieved December 31, 2015.

- ↑ "What if I chose to apply my federal refund to next year's taxes, filed, and later changed my mind?". TurboTax. Retrieved December 31, 2015.

- ↑ "Eight Facts on Late Filing and Late Payment Penalties". Internal Revenue Service. April 18, 2013. Retrieved December 31, 2015.

- ↑ Blankenship, Jim (May 17, 2011). "Adjusting Your Withholding and Estimated Tax Payments". Forbes. Retrieved January 1, 2016.

- 1 2 "IRS Publication 505, Chapter 1. Tax Withholding for 2015". Internal Revenue Service. Retrieved January 1, 2016.

- ↑ "Estimated Taxes: How to Determine What to Pay and When". TurboTax. Retrieved January 1, 2016.

- ↑ "Underpayment of Estimated Tax". H&R Block. Retrieved January 1, 2016.

- ↑ "1040 (2015)". Internal Revenue Service. Retrieved June 28, 2016.

- ↑ "Where is payment for failure-to-file and failure-to-pay penalties included on Form 1040?". money.stackexchange.com. Retrieved June 28, 2016.

- ↑ Chris Khan. "States With No Income Tax: Better or Worse?". Bankrate. Retrieved July 6, 2016.

- ↑ "2015 Form 540 - California Resident Income Tax Return" (PDF). State of California Franchise Tax Board. Retrieved June 18, 2016.

- ↑ "Frequently Asked Questions". TurboTax. Retrieved June 18, 2016.

- ↑ "Tax Topics - Deductible Taxes". Internal Revenue Service. Retrieved July 6, 2016.

- ↑ "How to Claim State Taxes on a Federal Tax Return". TurboTax. Retrieved July 6, 2016.

- ↑ 5 C.F.R. sec. 1320.6.

- ↑ The OMB control number is in the upper right corner of page 1 of the form. The short forms, Form 1040A and Form 1040EZ, also bear OMB control numbers.

- ↑ 919 F.2d 34, 90-2 U.S. Tax Cas. (CCH) paragr. 50,575 (6th Cir. 1990).

- ↑ United States v. Patridge, 507 F.3d 1092, 2007-2 U.S. Tax Cas. (CCH) paragr. 50,806 (7th Cir. 2007), cert. denied, 552 U.S. ___, 128 S. Ct. 1721 (2008).

- ↑ Judgment, page 2, docket entry 39, March 26, 2007, United States v. Lawrence, United States Court of Appeals for the Seventh Circuit, No. 06-3205.

- 1 2 "How You Must Pay Your Income Tax: Treasury Issues Form 1,040, Which Individuals Must Fill Out and File by March 1". The New York Times. January 6, 1914. p. 3.

- ↑ Jonnelle Marte (April 15, 2015). "100 years of tax form 1040". MarketWatch. Retrieved July 31, 2016.

- ↑ "RETURN OF ANNUAL NET INCOME OF INDIVIDUALS" (PDF). Internal Revenue Service. October 3, 1913. Retrieved January 1, 2016.

- ↑ "1913 Internal Revenue Service 1040 Form". Tax Foundation. Retrieved January 1, 2016.

- 1 2 3 "History Of The 1040 Form Runs Only 80 Years". Chicago Tribune. March 27, 1994. Retrieved July 31, 2016.

- 1 2 "Inflation Calculator". Bureau of Labor Statistics.

- ↑ "True Origin of the 1040 Income Tax Form". Retrieved January 1, 2016.

- ↑ See Publication 1796-A, IRS Historical Tax Products (rev. Feb. 2007), Internal Revenue Service, U.S. Dep't of the Treasury.

- 1 2 3 4 "Historical Highlights of the IRS". Internal Revenue Service. Retrieved December 31, 2015.

- ↑ Thorndike, Joseph J. "Tax History: The Love-Hate Relationship With the Standard Deduction". Tax History Project. Retrieved December 31, 2015.

- 1 2 Tasselmyer, Michael (April 8, 2015). "A Complex Problem: The Compliance Burdens of the Tax Code". National Taxpayers Union. Retrieved January 1, 2016.

- ↑ Yanofsky, David (December 13, 2012). "Line for line, US income taxes are more complex than ever". Quartz. Retrieved January 1, 2016.

- 1 2 "When tax complexity puts dinner on the table". Face the Facts USA. George Washington University. 15 August 2012. Retrieved 27 August 2012.

- ↑ "Tax Tables 2014" (PDF). Internal Revenue Service. Retrieved January 1, 2016.

- ↑ "Why is a tax table used in the US instead of just the piecewise linear rule?". Quora.

- ↑ King, Ritchie (April 14, 2013). "Check your US tax rate for 2012—and every year since 1913". Quartz. Retrieved January 1, 2016.

- ↑ Tax Policy: Summary of Estimates of the Costs of the Federal Tax System by the U.S. Government Accountability Office

- ↑ The Times is still wrong on taxation by Bruce Bartlett

- ↑ "Why do low-income families use tax preparers?". Tax Policy Center. Retrieved September 16, 2016.

- ↑ Lawrence Zelenak (2013). Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income Tax. The University of Chicago Press.

- ↑ "Taxes in Japan". Japan Guide. Retrieved December 31, 2015.