Economic effects of the Deepwater Horizon oil spill

| This article is part of a series about the |

| Deepwater Horizon oil spill |

|---|

|

This article covers the effect of the Deepwater Horizon disaster and the resulting oil spill on global and national economies and the energy industry.

Weeks after the event, and while it was still in progress, the 2010 Deepwater Horizon oil spill was being discussed as a disaster with far reaching consequences sufficient to impact global economies, marketplaces and policies. These potentially included structural shifts to energy policy, insurance marketplaces and risk assessment, and potential liabilities of the order of tens of billions of US dollars for one or more large and well known companies - principally BP.

Impact to the global industry

Oil industry impact

As a response to the disaster, on 30 April President Barack Obama ordered the federal government to hold the issuing of new offshore drilling leases until a review determined whether more safety systems were needed[1] and authorized teams to investigate 29 oil rigs in the Gulf in an effort to determine the cause of the disaster.[2] Later a six-month offshore drilling (below 500 feet (150 m) of water) moratorium was enforced by the United States Department of the Interior.[3] Secretary of the Interior Ken Salazar ordered immediate inspections of all deep-water operations in the Gulf of Mexico. An Outer Continental Shelf safety review board within the Department of the Interior is to provide recommendations for conducting drilling activities in the Gulf.[4] The moratorium suspended work on 33 rigs.[3] It was challenged by several drilling and oil services companies. On 22 June, a United States federal judge on the United States District Court for the Eastern District of Louisiana Martin Leach-Cross Feldman when ruling in the case Hornbeck Offshore Services LLC v. Salazar, lifted the moratorium finding it too broad, arbitrary and not adequately justified.[3] The Department of Justice appealed to the 5th Circuit Court of Appeals, which granted the request for an expedited hearing. A three judge panel is scheduled to hear oral arguments on 8 July.[5][6]

On 30 June, Salazar said that "he is working very hard to finalize a new offshore drilling moratorium".[7] Michael Bromwich, the head of the newly created Bureau of Ocean Energy Management, Regulation and Enforcement, said that a record of "bad performance, deadly performance" by an oil company should be considered "a relevant factor" for the government when it decides if that company should be awarded future drilling leases.[7] Representative George Miller plans to introduce to the energy reform bill under consideration in the United States House of Representatives that a company's safety record should factor into leasing decisions. By this amendment he wants to ban BP from leasing any additional offshore area for seven years because of "extensive record of serious worker safety and environmental violations".[8]

On 28 April, the National Energy Board of Canada, which regulates offshore drilling in the Canadian Arctic and along the British Columbia Coast, issued a letter to oil companies asking them to explain their argument against safety rules which require same-season relief wells.[9] Five days later, the Canadian Minister of the Environment Jim Prentice said the government would not approve a decision to relax safety or environment regulations for large energy projects.[10] On 3 May California Governor Arnold Schwarzenegger withdrew his support for a proposed plan to allow expanded offshore drilling projects in California.[11][12] On 8 July, Florida Governor Charlie Crist called for a special session of the state legislature to draft an amendment to the state constitution banning offshore drilling in state waters, which the legislature rejected on 20 July.[13][14]

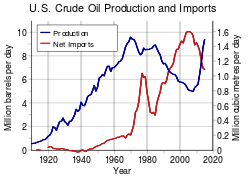

The U.S. Energy Information Administration (EIA) reported that in 2010, 23.5% of U.S. oil production came from offshore drilling in the Gulf of Mexico[15] The chief argument in the U.S. offshore drilling debate has been to make the United States less dependent on imported oil.[16][17] American dependence on imports grew from 24% in 1970[18] to 66% in 2008.[19]

Local officials in Louisiana expressed concern that the moratorium imposed in response to the spill would further harm the economies of coastal communities as the oil industry employs about 58,000 Louisiana residents and has created another 260,000 oil-related jobs, accounting for about 17% of all Louisiana jobs.[20]

Global insurance and reinsurance market impact

At the time of the disaster it was said that there were only 4 companies able to insure risks of such size.[21] The impact of Deepwater Horizon on insurance, reinsurance and other global markets due to the shift in systemic risk is as yet unknown. Until this incident loss of an entire semi-submersible rig in this way was considered "an unprecedented tragedy" [21] with an underwriter at Pritchard Capital commenting "It's never happened that a semi could burn into the sea and completely sink. Now underwriters have to include that as a risk. That’s probably $10,000 to $15,000 more per day in rig insurance. They’ll make it up by charging more on a per-rig basis." [21]

Impact on the UK economy

The Organization for International Investment, a Washington-based advocate for overseas investment into the U.S., warned in early July that the political rhetoric surrounding the disaster is potentially damaging the reputation of all British companies with operations in the U.S.[22] and sparked a wave of U.S. protectionism that has restricted British firms from; winning government contracts, making political donations, and lobbying.[23]

Impact on the US economy

Fisheries

In BP's Initial Exploration Plan, dated 10 March 2009, it said that "it is unlikely that an accidental spill would occur" and "no adverse activities are anticipated" to fisheries or fish habitat.[24] On 29 April 2010, Louisiana Governor Bobby Jindal declared a state of emergency in the state after weather forecasts predicted the oil slick would reach the Louisiana coast.[25] An emergency shrimping season was opened on 29 April so that a catch could be brought in before the oil advanced too far.[26] By 30 April, the USCG received reports that oil had begun washing up to wildlife refuges and seafood grounds on the Louisiana Gulf Coast.[27] On 22 May 2010, the Louisiana Seafood Promotion and Marketing Board stated said 60 to 70% of oyster and blue crab harvesting areas and 70 to 80% of fin-fisheries remained open.[28] The Louisiana Department of Health and Hospitals closed an additional ten oyster beds on 23 May, just south of Lafayette, Louisiana, citing confirmed reports of oil along the state's western coast.[29]

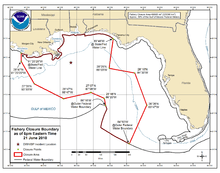

On 2 May 2010, NOAA closed commercial and recreational fishing in affected federal waters between the mouth of the Mississippi River and Pensacola Bay. The closure initially incorporated 6,814 square miles (17,650 km2).[30][31] By 21 June, NOAA had increased the area under closure over a dozen times, encompassing by that date 86,985 square miles (225,290 km2), or approximately 36% of Federal waters in the Gulf of Mexico, and extending along the coast from Atchafalaya Bay, Louisiana to Panama City, Florida.[32][33] On 24 May, the federal government declared a fisheries disaster for the states of Alabama, Mississippi and Louisiana.[34] Initial cost estimates to the fishing industry were $2.5 billion.[27]

On 23 June, NOAA ended its fishing ban in 8,000 square miles (21,000 km2), leaving 78,597 square miles (203,570 km2) with no fishing allowed,[35] or about one-third of the Gulf. The continued fishing ban was meant to assure the safety of seafood, and NOAA inspectors announced that as of 9 July, Kevin Griffis of the Commerce Department said, only one seafood sample out of 400 tested did not pass, and even that one did not include "concerning levels of contaminants".[36] On 10 August, Jane Lubchenco of NOAA said no one had seen oil in a 8,000 square miles (21,000 km2) area east of Pensacola since 3 July, so the fishing ban in that area was being lifted.[37]

On 31 August, a Boston lab hired by the United Commercial Fishermen's Association to analyze coastal fishing waters said it found dispersant in a seafood sample taken near Biloxi, Miss., almost a month after BP said it had stopped using the chemical.[38]

According to the European Space Agency, the agency's satellite data was used by the Ocean Foundation to conclude that 20% of the juvenile bluefin tuna were killed by oil in the gulf's most important spawning area. The foundation combined satellite data showing the oil spill extent each week with data on weekly tuna spawning to make their conclusion. The agency also said that the loss of juvenile tuna was significant due to the 82% decline of the tuna's spawning stock in the western Atlantic during the 30 years before the oil spill.[39]

The waters had been reopened to fishing on 15 November 2010,[40] but on 24 November NOAA re-closed 4,200 square miles (11,000 km2) area to shrimping.[41] A Florida TV station sent frozen Gulf shrimp to be tested for petroleum by-products after recent reports showed scientists disagreed on whether it is safe to eat after the oil spill.[42] A private lab found levels of Anthracene, a toxic hydrocarbon and a by-product of petroleum, at twice the levels the FDA finds acceptable.[43][44] On 20 April, NOAA reopened 1,041 square miles (2,700 km2) of Gulf waters immediately surrounding the Deepwater Horizon wellhead to commercial and recreational fishing of fish, oysters, crabs and shrimp after testing results found that 99 percent of samples contained no detectable dispersant residues or oil-related compounds, and the few samples that did contain residues showed levels more than 1000 times lower than FDA levels of concern. This was the twelfth and final reopening in federal waters since 22 July, and opened all the formerly closed areas in Federal waters.[45] Allowable levels for the toxins in Gulf seafood are based on health impacts for a 176-pound adult eating less than 2 medium shrimp per day.[46]

In July 2011 BP released a report[47] claiming that the economy had recovered and there was no reason to believe that anyone would suffer future losses from the spill, with the limited exception of oyster harvesters. However, Bruce Guerra, a crab fisherman in Louisiana for 25 years, said that since the BP oil spill crabbers are trapping 75 percent fewer crabs and that "crabs have been coming up dead, discolored, or riddled with holes since last year's spill". Others in the fishing industry say it could take years to fully realize the spill's effects. "The problem is right when they used the dispersants, that's when the tuna came to the Gulf to spawn," said Cheril Carey, a national sales representative for a Louisiana company specializing in yellow fin tuna. "It takes a tuna five to 15 years to mature. So although we may have fish now, we may not have them in five to 15 years."[48]

In late 2012 local fishermen report that crab, shrimp, and oyster fishing operations have not yet recovered from the oil spill and many fear that the Gulf seafood industry will never recover. One Mississippi shrimper who was interviewed said he used to get 8,000 pounds of shrimp in four days, but this year he got only 800 pounds a week. Mississippi's oyster reefs have been closed since the spill started. A Louisiana fisherman said the local oyster industry might do 35 per cent this year, "If we're very lucky." Dr Ed Cake, a biological oceanographer and a marine and oyster biologist, said that many of the Gulf fisheries have collapsed and "If it takes too long for them to come back, the fishing industry won't survive".[49]

Tourism

Although many people cancelled their vacations due to the spill, hotels close to the coasts of Louisiana, Mississippi, and Alabama reported dramatic increases in business during the first half of May 2010. However, the increase was likely due to the influx of people who had come to work with oil removal efforts. Jim Hutchinson, assistant secretary for the Louisiana Office of Tourism, called the occupancy numbers misleading, but not surprising. "Because of the oil slick, the hotels are completely full of people dealing with that problem," he said. "They're certainly not coming here as tourists. People aren't sport fishing, they aren't buying fuel at the marinas, they aren't staying at the little hotels on the coast and eating at the restaurants."[50]

On 25 May, BP gave Florida $25 million to promote the beaches where the oil had not reached, and the company planned $15 million each for Alabama, Louisiana, and Mississippi. The Bay Area Tourist Development Council bought digital billboards showing recent photos from the gulf coast beaches as far north as Nashville, Tennessee and Atlanta. Along with assurances that the beaches were so far unaffected, hotels cut rates and offered deals such as free golf. Also, cancellation policies were changed, and refunds were promised to those where oil may have arrived. However, revenues remained below 2009 levels.[50][51]

The U.S. Travel Association estimated that the economic impact of the oil spill on tourism across the Gulf Coast over a three-year period could exceed approximately $23 billion, in a region that supports over 400,000 travel industry jobs generating $34 billion in revenue annually.[52][53]

On 1 November, BP announced plans to spend $78 million to help Louisiana tourism and test and advertise seafood.[54]

Real estate prices

The real estate prices and a number of transactions in the Gulf of Mexico area decreased significantly during the period of the oil spill. As a result, area officials wanted the state legislature to allow property tax to be paid based on current market value, which according to Florida State Rep. Dave Murzin could mean millions of dollars in losses for each county affected.[55]

Impact on BP

BP - at the time the United Kingdom's largest corporation[56] and a major business in the UK investment world - came under intense popular, media, and political pressure to cancel its 2010 dividends in their entirety.[57] Media reports state that BP is of such a size and significance in that country, that "one pound in every seven" of investment and pension fund income in the UK is derived from BP.[58] Local media offered views on what this might mean for citizens.[59] As BP was reported to be "offloading billions of dollars in assets" in preparation,[60] some estimates suggested the total liability could amount to as much as US $100 billion (UK £67.5 bn) by the conclusion of the disaster.[61] Financial analysts commented that BP was capable of addressing the potential liabilities that might result, and BP stock rose slightly on the news that the initial US $20 billion compensation fund had been agreed.[60]

BP's expenditures on the oil spill

On 5 July 2010, BP reported that its own expenditures on the oil spill had reached $3.12 billion, including the cost of the spill response, containment, relief well drilling, grants to the Gulf states, claims paid, and federal costs.[62] As of 1 October 2010, BP has spent $11.2 billion.[54][63] As of March 2012, BP estimated the company's total spill-related expenses do not exceed $37.2 billion.[64]

The United States Oil Pollution Act of 1990 limits BP's liability for non-cleanup costs to $75 million unless gross negligence is proven.[65] BP has said it would pay for all cleanup and remediation regardless of the statutory liability cap. Nevertheless, some Democratic lawmakers sought to pass legislation that would increase the liability limit to $10 billion.[66][67] Analysts for Swiss Re have estimated that the total insured losses from the accident could reach $3.5 billion. According to UBS, final losses could be $12 billion.[68] According to Willis Group Holdings, total losses could amount to $30 billion, of which estimated total claims to the market from the disaster, including control of well, re-drilling, third-party liability and seepage and pollution costs, could exceed $1.2 billion.[69]

After announcement of the six-month moratorium on drilling in the deep-water Gulf of Mexico BP agreed to allocate $100 million for payments to offshore oil workers who were unemployed due to the moratorium.[70]

Market value

BP's stock fell by 52% in 50 days on the New York Stock Exchange, going from $60.57 on 20 April 2010, to $29.20 on 9 June, its lowest level since August 1996. On 25 June, BP's market value reached a 1-year low. The company's total value lost since 20 April was $105 billion. Investors saw their holdings in BP shrink to $27.02, a nearly 54% loss of value in 2010.[71] A month later, the company's loss in market value totalled $60 billion, a 35% decline since the explosion. At that time, BP reported a second-quarter loss of $17 billion, its first loss in 18 years. This included a one-time $32.2 billion charge, including $20 billion for the fund created for reparations and $2.9 billion in actual costs.[72]

BP announced that it was setting up a new unit to oversee management of the oil spill and its aftermath, to be headed by former TNK-BP chief executive Robert Dudley,[73] who a month later was named CEO of BP.[72]

On 1 October, BP's London Stock Exchange price reached 439.75 pence, the highest point since 28 May.[63]

By 2013, BP had dropped from the second to the fourth largest of the four major oil companies.[74]

On 4 September 2014, when BP was found guilty of gross negligence and willful misconduct under the Clean Water Act (CWA), which could see it liable for up to $18 billion in additional fines, the company's shares lost 6 percent of their value.[75]

Drop in sale

BP gas stations in the United States, the majority of which the company does not own, reported sales off between 10 and 40% due to backlash against the company. Some BP station owners that lost sales said the name should change back to Amoco, while others said after all the effort that went into promoting BP, such a move would be a gamble, and the company should work to restore its image.[76]

See also

References

- ↑ Johnston, Nicholas; Nichols, Hans (1 May 2010). "New Offshore Oil Drilling Must Have Safeguards, Obama Says". Bloomberg. Retrieved 1 May 2010.

- ↑ CBS/AP (29 April 2010). "Oil Spill Reaches Mississippi River". CBS News. Retrieved 29 April 2010.

- 1 2 3 "Judge denies stay in moratorium ruling". Upstream Online. NHST Media Group. 24 June 2010. Retrieved 2010-06-30.

- ↑ Brenner, Noah; Guegel, Anthony; Hwee Hwee, Tan; Pitt, Anthea (30 April 2010). "Congress calls Halliburton on Macondo". Upstream Online. NHST Media Group. Retrieved 2010-05-01.

- ↑ Fisk, M. C.; Calkins, L. (29 June 2010). "Court grants speedy hearing for U.S. on drill ban". Business Week. Bloomberg. Archived from the original on 2 July 2010. Retrieved 2010-07-04.

- ↑ Tracy, Tennille (29 June 2010). Court To Hear Arguments In Drilling Moratorium Case 8 July. NASDAQ. Dow Jones Newswires. Retrieved 2010-07-04. Archived 11 June 2011 at the Wayback Machine.

- 1 2 "Salazar prepping new deep-water drill ban". Upstream Online. NHST Media Group. 30 June 2010. Retrieved 2010-06-30.

- ↑ "Lawmaker wants 7-year BP lease ban". Upstream Online. NHST Media Group. 30 June 2010. Retrieved 2010-06-30.

- ↑ VanderKlippe, Nathan (30 April 2010). "Arctic drilling faces tougher scrutiny". The Globe and Mail. Canada. pp. B1, B8. Retrieved 2010-05-02.

- ↑ Robertson, Grant; Galloway, Gloria (5 May 2010). "Ottawa talks tough on offshore drilling". The Globe and Mail. Canada. pp. A1, A13. Archived from the original on 6 May 2010. Retrieved 2010-05-05.

- ↑ Wood, Daniel B. (4 May 2010). "Citing BP oil spill, Schwarzenegger drops offshore drilling plan". The Christian Science Monitor. Retrieved 2010-05-06.

- ↑ Mirchandani, Rajesh (3 May 2010). "California's Schwarzenegger turns against oil drilling". BBC News. Retrieved 2010-05-06.

- ↑ Associated Press (8 July 2010). "Fla. governor calls special oil drilling session". The Miami Herald. Archived from the original on 20 July 2010. Retrieved 2010-07-08.

- ↑ Bosquet, Steve (20 July 2010). "Party-line vote ends Florida's oil drilling ban special session". The Miami Herald. Archived from the original on 2 August 2010. Retrieved 2010-07-20.

- ↑ "Q&A: Deep-water drilling restrictions". BBC News. 27 September 2010. Retrieved 2010-06-30.

- ↑ "Can Offshore Drilling Really Make the U.S. Oil Independent?". Scientific American. 12 September 2008.

- ↑ "Barreling Toward Peak Oil". Bloomberg BusinessWeek. 27 May 2010.

- ↑ "Pickens: Let's drop dependence on foreign oil". Denver Business Journal. 10 July 2008.

- ↑ "Frequently Asked Questions – Crude Oil". U.S. Energy Information Administration (EIA).

- ↑ Sasser, Bill (24 May 2010). "Despite BP oil spill, Louisiana still loves Big Oil". The Christian Science Monitor.

- 1 2 3 Gunter, Ford (28 April 2010). "An Explosive Situation". Portfolio.com. Retrieved 2010-06-17.

- ↑ Teather, David (14 July 2010). "British companies' reputation in the US is under threat, warns Washington overseas investment group". The Guardian. London. Retrieved 16 July 2010.

- ↑ Mason, Rowena (10 July 2010). "UK firms suffer after BP oil spill". The Daily Telegraph. London. Retrieved 2010-07-19.

- ↑ Griffitt, Michelle. "Initial Exploration Plan Mississippi Canyon Block 252 OCS-G 32306" (PDF). BP Exploration and Production. New Orleans, Louisiana: Minerals Management Service. Archived from the original (PDF) on 5 July 2010.

- ↑ "State of emergency declared as oil spill nears Louisiana coast". CNN. 29 April 2010. Retrieved 2010-04-29.

- ↑ "Oil 'reaches' US Gulf Coast from spill". BBC News. 30 April 2010. Retrieved 2010-04-30.

- 1 2 "Bryan Walsh. (1 May 2010). Gulf of Mexico Oil Spill: No End in Sight for Eco-Disaster. Time. Retrieved 2010-05-01". Yahoo! News. 1 May 2010. Retrieved 2010-05-03.

- ↑ Jones, Steve (22 May 2010). "Wholesale seafood prices rising as oil spill grows". The Sun News. Retrieved 2010-05-22.

- ↑ "In Precautionary Move, DHH Closes Additional Oyster Harvesting Areas West of the Mississippi Due to Oil Spill". State of Louisiana Department of Health and Hospitals. 23 May 2010. Retrieved 2010-05-24.

- ↑ "NOAA Closes Commercial and Recreational Fishing in Oil-Affected Portion of Gulf of Mexico". Deepwater Horizon Incident Joint Information Center. 2 May 2010. Retrieved 2 May 2010.

- ↑ "FB10-029: Deepwater Horizon Oil Spill: Emergency Area Closure in the Gulf of Mexico" (PDF). NOAA, National Marine Fisheries Service, Southeast Regional Office, Southeast Fishery Bulletin. 3 May 2010. Archived from the original (PDF) on 1 May 2011. Retrieved 3 June 2010.

- ↑ "FB10-055: BP Oil Spill: NOAA Modifies Commercial and Recreational Fishing Closure in the Oil-Affected Portions of the Gulf of Mexico" (PDF). NOAA, National Marine Fisheries Service, Southeast Regional Office, Southeast Fishery Bulletin. 21 June 2010. Archived from the original (PDF) on 5 July 2010. Retrieved 2010-06-22.

- ↑ "Deepwater Horizon/BP Oil Spill: Size and Percent Coverage of Fishing Area Closures Due to BP Oil Spill". NOAA, National Marine Fisheries Service, Southeast Regional Office. 21 June 2010. Archived from the original on 18 June 2010. Retrieved 2010-06-22.

- ↑ Bruce Alpert (25 May 2010). "The feds declare fisheries disaster in La., Miss., Ala.". Times-Picayune. Retrieved 2010-05-25.

- ↑ Elswick, Ryan (27 June 2010). "Fishing charters see new boost". The Sun News. Retrieved 2010-07-02.

- ↑ Skoloff, Brian (10 July 2010). "NOAA: Gulf seafood tested so far is safe to eat". The Sun News. Associated Press. Archived from the original on 13 July 2010. Retrieved 2010-07-10.

- ↑ "Some fishing areas off Fla. Panhandle reopened". CBS News. Associated Press. 11 August 2010. Retrieved 2010-12-19.

- ↑ Laura Parker Contributor. "New Lab Results Raise Questions About Gulf Seafood's Safety". Aolnews.com. Archived from the original on 3 September 2010. Retrieved 2010-09-05.

- ↑ ESA Portal – Bluefin tuna hit hard by ‘Deepwater Horizon’ disaster. Esa.int (18 October 2010). Retrieved 2011-04-07.

- ↑ Oil covers catch hauled in by shrimpers. Fox10tv.com (22 November 2010). Retrieved 2011-04-07.

- ↑ NOAA Closes 4,200 Square Miles of Gulf Waters to Royal Red Shrimping. RestoreTheGulf.gov (24 November 2010). Retrieved 2011-04-07.

- ↑ Gulf seafood safe? Experts disagree. Abcactionnews.com (22 November 2010). Retrieved 2011-04-07.

- ↑ PDF Documents From WFTV Eyewitness News Orlando. Wftv.com. Retrieved 2011-04-07. Archived 13 September 2011 at the Wayback Machine.

- ↑ Laboratory Test Results Raise Concern Over Gulf Seafood – News Story – WFTV Orlando. Wftv.com. Retrieved 2011-04-07. Archived 13 September 2011 at the Wayback Machine.

- ↑ "All U.S. federal waters of the Gulf of Mexico once closed to fishing due to spill now open". Sciencedaily.com. 20 April 2011. Retrieved 2011-11-05.

- ↑ AlterNet / By Lisa Kaas Boyle (18 April 2012). "Eyeless Shrimp and Fish With Tumors: The Horrific Consequences of BP's Spill". AlterNet. Retrieved 2012-06-01.

- ↑ (PDF) https://web.archive.org/web/20120515155758/http://gulfcoastclaimsfacility.com/BP_7_7_11_Supplemental_Comment.pdf. Archived from the original (PDF) on 15 May 2012. Retrieved 9 February 2013. Missing or empty

|title=(help) - ↑ "Fishermen angry as BP pushes to end payments for future losses | wwltv.com New Orleans". Wwltv.com. Retrieved 2011-11-05.

- ↑ Gulf fisheries in decline after oil disaster - Features - Al Jazeera English

- 1 2 Reed, Travis (27 May 2010). "Spill hasn't yet emptied hotels on Gulf Coast". The Sun News. Associated Press. Retrieved 2010-05-27.

- ↑ Anderson, Lorena (4 June 2010). "Oil could hit Myrtle Beach area by July". The Sun News. Retrieved 2010-06-04.

- ↑ Proctor, Carleton (1 August 2010). "Big price tag for recovery of Gulf Coast". Pensacola News Journal. Retrieved 2010-08-01.

- ↑ Oxford Economics (21 July 2010). "Potential Impact of the Gulf Oil Spill on Tourism" (PDF). Retrieved 2010-08-01.

- 1 2 Skoloff, Brian; Wardell, Jane (2 November 2010). "BP's oil spill costs grow, Gulf residents react". The Washington Post. Associated Press. Retrieved 2010-11-03.

- ↑ Farrington, Brendan (23 June 2010). "Gulf property sales slide further on oil fears". The Sun News. Associated Press. Archived from the original on 2 July 2010. Retrieved 2010-06-23.

- ↑ Louise Armitstead; Myra Butterworth; Alastair Jamieson (10 June 2010). "BP oil spill: shares plummet as US warns it will 'take action' to stop dividend". The Telegraph. London. Retrieved 2010-06-18.

- ↑ Mike Memoli; Peter Nicholas (16 June 2010). "BP agrees to $20-billion escrow fund; cancels dividends". Los Angeles Times. Retrieved 2010-06-18.

- ↑ "BP shares tumble on dividend fears". Yahoo Finance / AFP Business News. 18 June 2010. Retrieved 2010-06-10.

- ↑ "BP crisis: The impact on your savings and investments". BBC News. 17 June 2010. Retrieved 2010-06-18.

- 1 2 Beatty, Andrew (17 June 2010). "BP readies war chest as spill costs mount". AFP. Retrieved 2010-06-18.

- ↑ Spillius, Andrew (18 June 2010). "BP oil spill could cost $100bn". The Telegraph. London. Retrieved 2010-06-18.

- ↑ Breen, Tom (5 July 2010). "BP costs for oil spill response pass $3 billion". The Associated Press. Retrieved 2010-07-05.

- 1 2 Wardell, Jane (1 October 2010). "BP says oil spill costs rise to $11.2 billion". The Washington Post. The Associated Press. Retrieved 2010-10-01.

- ↑ Fahey, Jonathan; Kahn, Chris (3 March 2012). "BP begins to put spill behind it with settlement". CBN News. The Associated Press. Retrieved 20 January 2013.

- ↑ Werner, Erica (3 May 2010). "Federal law may limit BP liability in oil spill". ABC News. Associated Press. Archived from the original on 18 February 2011. Retrieved 2010-06-29.

- ↑ "Spill triggers effort to up liability cap".(subscription required)

- ↑ Doggett, Tom (25 May 2010). Congress can stick BP with bigger liability cap Reuters.

- ↑ Pagnamenta, Robin (26 May 2010). "Lloyd's syndicates launch legal action over BP insurance claim". The Times. Retrieved 2010-05-26.

- ↑ "Macondo slugs insurance rates". Upstream Online. NHST Media Group. 4 June 2010. Retrieved 2010-06-04.

- ↑ Brenner, Noah (17 June 2010). "Hayward says spill 'never should have happened'". Upstream Online. NHST Media Group. Retrieved 2010-06-17.

- ↑ Tharp, Paul (25 June 2010). "Stormy weather: BP's stock hits new low". New York Post. Retrieved 2010-06-27.

- 1 2 Wardell, Jane (27 July 2010). "BP replaces CEO Hayward, reports $17 billion loss". Associated Press. Archived from the original on 30 September 2010. Retrieved 2010-12-19.

- ↑ Brenner, Noah; Pitt, Anthea (8 June 2010). "BP calls in FPSO for Macondo". Upstream Online. NHST Media Group. Retrieved 2010-06-08.

- ↑ "Smaller BP's profits down as oil spill trial looms". Reuters. 5 February 2013.

- ↑ "BP found "grossly negligent' in Gulf of Mexico oil sp". New Orleans Sun. 4 September 2014. Retrieved 5 September 2014.

- ↑ Weber, Harry (19 December 2010). "Time to scrap BP brand? Gas-station owners divided". Associated Press. Retrieved 2010-07-30.