Chepakovich valuation model

The Chepakovich valuation model uses the discounted cash flow valuation approach. It was first developed by Alexander Chepakovich in 2000 and perfected in subsequent years.[1] The model was originally designed for valuation of “growth stocks” (ordinary/common shares of companies experiencing high revenue growth rates) and is successfully applied to valuation of high-tech companies, even those that do not generate profit yet. At the same time, it is a general valuation model and can also be applied to no-growth or negative growth companies. In a limiting case, when there is no growth in revenues, the model yields similar (but not the same) valuation result as a regular discounted cash flow to equity model.

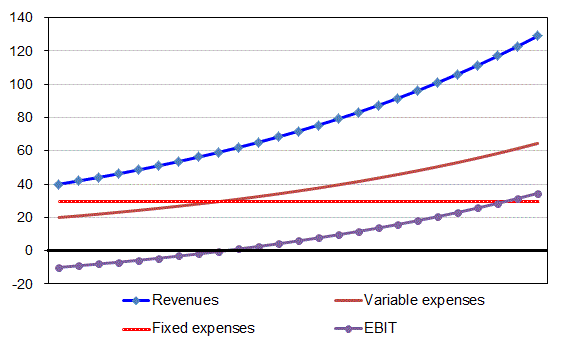

The key distinguishing feature of the Chepakovich valuation model is separate forecasting of fixed (or quasi-fixed) and variable expenses for the valuated company.[2] The model assumes that fixed expenses will only change at the rate of inflation or other predetermined rate of escalation, while variable expenses are set to be a fixed percentage of revenues (subject to efficiency improvement/degradation in the future – when this can be foreseen). Chepakovich suggested that the ratio of variable expenses to total expenses, which he denoted as variable cost ratio, is equal to the ratio of total expenses growth rate to revenue growth rate.[3] This feature makes possible valuation of start-ups and other high-growth companies on a fundamental basis, i.e. with determination of their intrinsic values. Such companies initially have high fixed costs (relative to revenues) and small or negative net income. However, high rate of revenue growth insures that gross profit (defined here as revenues minus variable expenses) will grow rapidly in proportion to fixed expenses. This process will eventually lead the company to predictable and measurable future profitability. Unlike other methods of valuation of loss-making companies, which rely primarily on use of comparable valuation ratios, and, therefore, provide only relative valuation, the Chepakovich valuation model estimates intrinsic (i.e. fundamental) value.

Other distinguishing and original features of the Chepakovich valuation model are:

- Variable discount rate (depends on time in the future from which cash flow is discounted to the present) to reflect investor’s required rate of return (it is constant for a particular investor) and risk of investment (it is a function of time and riskiness of investment).[4] The base for setting the discount rate is the so-called risk-free rate, i.e. the yield on a corresponding zero-coupon Treasury bond. The riskiness of investment is quantified through use of a risk-rating procedure.

- Company’s investments in means of production (it is the sum of tangible and intangible assets needed for a company to produce a certain amount of output – we call it ‘production base’) is set to be a function of the revenue growth (there should be enough production capacity to provide increase in production/revenue). Surprisingly many discounted cash flow (DCF) models used today do not account for additional production capacity need when revenues grow.

- Long-term convergence of company’s revenue growth rate to that of GDP.[5] This follows from the fact that combined revenue growth of all companies in an economy is equal to GDP growth and from an assumption that over- or underperformance (compared to the GDP) by individual companies will be eliminated in the long run (which is usually the case for the vast majority of companies – so vast, indeed, that the incompliant others could be treated as a statistical error).

- Valuation is conducted on the premise that change in company’s revenue is attributable only to company’s organic growth rate. This means that historical revenue growth rates are adjusted for effects of acquisitions/divestitures.

- Factual cost of stock-based compensation of company’s employees that does not show in the company’s income statement is subtracted from cash flows. It is determined as the difference between the amount the company could have received by selling the shares at market prices and the amount it received from selling shares to employees (the actual process of stock-based compensation could be much more complicated than the one described here, but its economic consequences are still the same).

- It is assumed that, subject to availability of the necessary free cash flow, the company’s capital structure (debt-to-equity ratio) will converge to optimal. This would also have an effect on the risk rating of the company and the discount rate. The optimal capital structure is defined as the one at which the sum of the cost of debt (company’s interest payments) and its cost of equity (yield on an alternative investment with the same risk – it is a function of the company’s financial leverage) is at its minimum.

Performance of the model in 2015

For the whole of 2015, U.S. stocks rated by the Chepakovich valuation model demonstrated the following performance:[6]

The chart below depicts time-series of average stock performance (in %) in each of the stock rating category throughout the year 2015 in comparison with the performance of the S&P 500 index.

See also

References

- ↑ "Valuation", 2013, ISBN 1230591109, ISBN 9781230591100

- ↑ "Fundamental Analysis", 2013, ISBN 1230622985, ISBN 9781230622989

- ↑ http://x-fin.com/valuation/chepakovich-valuation-model/

- ↑ Amine Bouchentouf, Brian Dolan, Joe Duarte, Mark Galant, Ann C. Logue, Paul Mladjenovic, Kerry Pechter, Barbara Rockefeller, Peter J. Sander, Russell Wild, "High-Powered Investing All-In-One For Dummies", 2008, ISBN 978-0-470-18626-8, p. 596.

- ↑ Peter J. Sander, Janet Haley, "Value Investing For Dummies", 2008, ISBN 978-0-470-23222-4, p. 214.

- ↑ http://x-fin.com/stocks/performance/