Economy of Switzerland

|

| |

| Currency | Swiss franc (CHF) |

|---|---|

| Calendar year | |

Trade organisations | EFTA, WTO and OECD |

| Statistics | |

| GDP |

|

| GDP rank | 20th (nominal) / 35th (PPP)[1] |

GDP growth |

|

GDP per capita |

|

GDP by sector |

agriculture (1.3%) industry (27.7%) services (71.0%) (2012 est.) |

|

| |

Population below poverty line |

|

|

| |

Labour force | 5.4 million (2013)[2] |

Labour force by occupation |

agriculture (3.4%) Industry (23.4%) services (73.2%) (2010) |

| Unemployment |

|

Average gross salary | 6,214 CHF/ $6,240, month (2014) |

| 5,102 CHF/ $5,120, month (2014) | |

Main industries | machinery, chemicals, watches, textiles, precision instruments, tourism, banking, insurance |

| 28th[4] | |

| External | |

| Exports |

|

Export goods | machinery, chemicals, metals, watches, agricultural products |

Main export partners |

|

| Imports |

|

Import goods | machinery, chemicals, vehicles, metals; agricultural products, textiles |

Main import partners |

|

FDI stock |

|

Gross external debt | $1.346 trillion (30 June 2011) |

| Public finances | |

|

| |

| Revenues |

|

| Expenses |

|

| Economic aid | donor: ODA CHF2.31 billion (0.47% of GDP)[8] |

Foreign reserves |

|

The economy of Switzerland is one of the world's most stable economies. Its policy of long-term monetary security and political stability has made Switzerland a safe haven for investors, creating an economy that is increasingly dependent on a steady tide of foreign investment.

Because of the country's small size and high labor specialization, industry and trade are the keys to Switzerland's economic livelihood. Switzerland has achieved one of the highest per capita incomes in the world with low unemployment rates and a balanced budget. The service sector has also come to play a significant economic role. The economy of Switzerland ranks first in the world in the 2015 Global Innovation Index.[11]

History

19th century

Switzerland as a federal state was established in 1848. Before that time, the city-cantons of Zurich and Basel in particular began to develop economically based on industry and trade, while the rural regions of Switzerland remained poor and under-developed. While a workshop system had been in existence throughout the early modern period, the production of machines began in 1801 in St. Gallen, with the third generation of machines imported from Great Britain. But in Switzerland, hydraulic power was often used instead of steam-engines because of the country's topography while there are no significant deposits of coal. By 1814, hand weaving had been mostly replaced by the power loom. Both tourism and banking began to develop as an economic factor from about the same time. While Switzerland was primarily rural, the cities experienced an industrial revolution in the late 19th century, focused especially on textiles. In Basel, for example, textiles, including silk, were the leading industry. In 1888 women made up 44% of the wage earners. Nearly half the women worked in the textile mills, with household servants the second largest job category. The share of women in the workforce was higher between 1890 and 1910 than it was in the late 1960s and 1970s.[12]

Railways played a major part in industrialization with the first railway appearing in 1847 between Zurich and Baden. Due to competition between private players, Switzerland was covered with more than 1000 km of track by 1860.[13]

20th century

The industrial sector began to grow in the mid-19th century, but Switzerland's emergence as one of the most prosperous nations in Europe, sometimes termed the "Swiss miracle" was a development of the short 20th century, among other things tied to the role of Switzerland during the World Wars.[14]

During World War I, Switzerland suffered an economic crisis. It was marked by a decrease in energy consumption, energy being mostly produced by coal in the 1910s, 1920s, 1930s and 1940s. The war tax was introduced. As imports were difficult, attempts were made to strengthen the Swiss economy.

Switzerland's total energy consumption, which was dropping from the mid 1910s to the early 1920s, started increasing during the early 1920s. The same got stagnated during the 1930s before dropping again during the early 1940s before an exponential growth which started in the mid 1940s.[15]

In the 1940s, particularly during World War II, the economy profited from the increased export and delivery of weapons to the German Reich, France, Great Britain, and other neighbouring and close countries. However, Switzerland's energy consumption decreased rapidly. The conduct of the banks cooperating with the Nazis (but not exclusively; they also cooperated extensively with the British and French) and commercial relations with the Axis powers during the war became the subject of sharp criticism, resulting in a short period of international isolation of Switzerland from the world. After World War II, Switzerland's production facilities remained to a great extent undamaged, which facilitated the country's swift economic resurgence. .

In the 1950s, annual GDP growth averaged 5% and Switzerland's energy consumption doubled. Coal lost its rank as Switzerland's primary energy source, as other fossil fuels such as crude and refined oil and natural and refined gas imports increased. This decade also marked the transition from an industrial economy to a service economy. Since then the service sector has been growing faster than the agrarian and industrial sectors .

In the 1960s, annual GDP growth averaged 4% and Switzerland's energy consumption doubled. By the end of the decade oil was Switzerland's primary energy source .

In the 1970s GDP growth rates gradually declined from a peak of 6.5% in 1970 until contracting 7.5% in 1975 and 1976. Switzerland became increasingly dependent on oil imported from its main supplier, the OPEC cartel. The 1973 international oil crisis caused Switzerland's energy consumption to decrease in the years from 1973 to 1977. In 1974 there were three nationwide car-free Sundays when private transport was prohibited as a result of the oil supply shock. From 1977 onwards GDP grew, although Switzerland was also affected by the 1979 energy crisis which resulted in a short-term decrease in Switzerland's energy consumption .

In the 1980s Switzerland was affected by the hike in oil prices which resulted in a decrease of energy consumption until 1982, when the economy contracted by 1.3%. From 1983 on both GDP and energy consumption grew .

Switzerland's economy was marred by slow growth in the 1990s, having the weakest economic growth in Western Europe. The economy was affected by a 3-year-recession from 1991 to 1993 when the economy contracted by 2%. The contraction also became apparent in Switzerland's energy consumption and export growth rates. Switzerland's economy averaged no appreciable increase (only 0.6% annually) in gross domestic product (GDP).

After having unemployment rates lower than 1% prior to 1990, the 3-year-recession also caused the unemployment rate to rise to its all-time peak of 5.3% in 1997. As of 2008, Switzerland was at the second place among European countries with populations above one million in terms of nominal and purchasing power parity Gross Domestic Product per capita, behind Norway (see list). On numerous occasions in the 1990s real wages decreased since nominal wages could not keep up with inflation. However, beginning in 1997, a global resurgence in currency movement provided the necessary stimulus to the Swiss economy. It slowly gained momentum and peaked in the year 2000 with 3.7% growth in real terms.[16]

2000s

In the early 2000s recession, being so closely linked to the economies of Western Europe and the United States, Switzerland was not able to escape the slowdown felt in these countries. After the worldwide stock market crashes in the wake of the 9/11 terrorism attacks there were more announcements of false enterprise statistics and exaggerated managers' wages. In 2001 the rate of growth dropped to 1.2%, to 0.4% in 2002 and in 2003 the real GDP contracted by 0.2%. That economic slowdown had a noticeable impact on the labour market.

Many companies announced mass dismissals and thus the unemployment rate rose from its low of 1.9% in June 2000 to its peak of 3.9% in October 2004, although well below the European Union (EU) unemployment average of 8.9%. The consumer mood worsened and domestic consumption decreased.

The exports of goods and services in the EU and the USA decreased as a result of the Swiss Franc's appreciation in value which caused an increase in prices of exported goods and services. On the other hand, Switzerland's tourism sector slumped and room occupation rates by foreign guests decreased. Besides that a deficit of market competition in many branches of Switzerland's economy persisted.

On the 10.11.2002 the economics magazine Cash published 5 measures which political and economic factors were suggested to implement so that Switzerland would once again experience an economic revival:

1. Private consumption should be promoted with decent wage increases. In addition to that families with children should get discounts on their health insurances.

2. Switzerland's national bank should revive investments by lowering interest rates. Besides that monetary institutes should increasingly credit consumers and offer cheaper land zones which are to be built on.

3. Switzerland's national bank is asked to devalue the Swiss Franc, especially compared to the Euro.

4. The government should implement the anti-cyclical measure of increasing budget deficits. Government spending should increase in the infrastructural and educational sectors. Lowering taxes would make sense in order to promote private household consumption.

5. Flexible work schedules should be instituted, thus avoiding low demand dismissals.

These measures were applied with successful results along with the government's policy of the Magical Hexagon which consists of full employment, social equality, economic growth, environmental quality, positive trade balance and price stability. The rebound which started in mid-2003 saw growth rate growth rate averaging 3% (2004 and 2005 saw a GDP growth of 2.5% and 2.6% respectively; for 2006 and 2007, the rate was 3.6%). In 2008, GDP growth was modest in the first half of the year while declining in the last two quarters. Because of the base effect, real growth came to 1.9%. While it contracted 1.9% in 2009, the economy started to pick up in Q3 and by the second quarter of 2010, it had surpassed its previous peak. Growth for 2010 stood at 2.6%[17]

The stock market collapse has deeply affected investment income earned abroad. This has translated to a substantial fall in the surplus of the current account balance. In 2006, Switzerland recorded a 15.1% per GDP surplus. It went down to 9.1% in 2007 and further dropped to 1.8% in 2008. It recovered in 2009 and 2010 with a surplus of 11.9% and 14.6% respectively. As of the first quarter 2010, Switzerland house prices are still edging up.[18]

This is a chart of trend of gross domestic product of Switzerland at market prices estimated[17] by the Swiss Government with figures in millions of Swiss Francs.

| Year | Gross Domestic Product | US Dollar Exchange |

|---|---|---|

| 1980 | 184,080 | 1.67 Francs |

| 1985 | 244,421 | 2.43 Francs |

| 1990 | 330,925 | 1.38 Francs |

| 1995 | 373,599 | 1.18 Francs |

| 2000 | 422,063 | 1.68 Francs |

| 2005 | 463,799 | 1.24 Francs |

| 2006 | 490,545 | 1.25 Francs |

| 2007 | 521,068 | 1.20 Francs |

| 2008 | 547,196 | 1.08 Francs |

| 2009 | 535,282 | 1.09 Francs |

| 2010 | 546,245 | 1.04 Francs |

| 2011 | 659.3 | 0.75 Francs |

| 2012 | 632.2 | ... |

Economic sectors

The Swiss economy follows the typical First World model with respect to the economic sectors. Only a small minority of the workers are involved in the primary or agricultural sector (1.3% of the population, in 2006) while a larger minority is involved in the secondary or manufacturing sector (27.7% in 2012). The majority of the working population are involved in the tertiary or services sector of the economy (71.0% in 2012).[19]

While most of the Swiss economic practices have been brought largely into conformity with the European Union's policies, some trade protectionism remains, particularly for the small agricultural sector.[20]

Watches

Switzerland is one of the leaders in exports of high-end watches as well as clocks, Swiss watch making companies produce most of the world's high-end watches, in 2011, the exports of Switzerland reached nearly 19.3 billion CHF. Swiss watch manufacturers exceeded their previous annual result by 19.2%. The exports of those watches mainly go to Asia (55%), Europe (29%), Americas (14%), Africa and Oceania (both 1%).[21]

In USD, Switzerland has an export, in 2011, of over USD$20 billion, making it the country with the highest export value of watches, followed by Hong Kong, at under USD$10 billion.[21]

However, China mainland exports the most watches (all watches), at a total of 682.1+ units (in millions), followed by Hong Kong at 402.7, then Switzerland at 29.8 million units.[21]

Industrial

Switzerland has an extensive industrial sector, which is not very well known around the world, but present with companies in different industrial sectors, such as: food processing like Nestlé, chemical for industrial and construction use like Sika AG, pharmaceutical like Novartis and Roche and roof coating chemicals Sarnafil. LafargeHolcim is the largest construction materials group in the world.

Agriculture

Switzerland is extremely protective of its agricultural industry. High tariffs and extensive domestic subsidisations encourage domestic production, which currently produces about 60% of the food consumed in the country.

According to the Organisation for Economic Co-operation and Development (OECD), Switzerland is subsidising more than 70% of its agriculture compared to 35% in the EU. The 2007 Agricultural Program, recently adopted by the Swiss Federal Assembly, will increase subsidies by CHF 63 million to CHF 14.092 billion.

Protectionism acts to promote domestic production, but not to reduce prices or the cost of production, and there is no guarantee the increased domestic production is actually consumed internally; it may simply be exported, to the profit of the producers. 90 to 100% of potatoes, vegetables, pork, veal, cattle and most milk products are produced in the country. Beyond that, Swiss agriculture meets 65% of the domestic food demand.[22]

The first reform in agricultural policies was in 1993. Among other changes, since 1998 Switzerland has linked the attribution of farm subsidies with the strict observance of good environmental practice. Before farmers can apply for subsidies, they must obtain certificates of environmental management systems (EMS) proving that they: "make a balanced use of fertilizers; use at least 7% of their farmland as ecological compensation areas; regularly rotate crops; adopt appropriate measures to protect animals and soil; make limited and targeted use of pesticides."[23] 1,500 farms are driven out of business each year. But the number of organic farms increased by 3.3 percent between 2003 and 2004, and organic sales increased by 7 percent to $979 million.[24] Moreover, Swiss consumers consider less important the drawback of higher prices for organic food compared to conventional locally-produced food.[22]

Trade

The CIA World Factbook estimates Switzerland's 2011 exports at $308.3 billion and the 2010 exports at $258.5 billion. Imports are estimated to be $299.6 billion in 2011 and $246.2 billion in 2010. According to the World Factbook numbers, Switzerland is the 20th largest exporter and the 18th largest importer.[20]

The United Nations Commodity Trade Statistics Database has lower numbers for Switzerland's exports and imports. The UN calculates exports at $223.5 billion in 2011 and $185.8 billion in 2010. The value of all imports in 2011 was $197.0 billion and in 2010 it was $166.9 billion.[25]

Switzerland's largest trading partner is Germany. In 2009, 21% of Switzerland's exports and 29% of its imports came from Germany. The United States was the second largest destination of exports (9.1% of total exports) and the fourth largest source of imports (6.7%).[26]

Switzerland's neighbors made up next largest group; Italy was third for exports (8.6%) and second for imports (10%), France was fourth for exports (8%) and third for imports (8.1%) and Austria was fifth for exports (4.6%) and sixth for imports (3.7%). Major non-European trading partners included; Japan (seventh for exports with 3.6% and twelfth for imports with 2%), China (eighth for exports and imports with 3.1% and 2.5% respectively) and Turkey (sixteenth for exports with 1.2% and ninth for imports with 2.3%).[26]

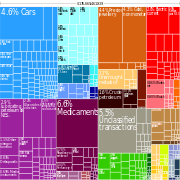

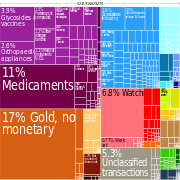

As a first world country with a skilled labor force, the majority of Swiss exports are precision or 'high tech' finished products. Switzerland's largest specific SITC categories of exports include; medicaments, glycosides and vaccines, watches, orthopaedic appliances and precious jewellery. Some raw ores or metals are exported, but the majority of the exports in this category are finished jewellery or other finished products. Agricultural products that Switzerland is famous for, such as cheese (0.29%), wine (0.05%) and chocolate (0.39%) all make up only a small portion of Swiss exports and agricultural products make up only a small portion of all exports.[26] Switzerland is also a significant exporter of arms and ammunition, and the third largest for small calibers,[27] which accounted for 0.33% of the total exports in 2012.[28]

Switzerland's main imports include; medicaments, cars, precious jewellery and other unclassified transactions. While Switzerland has a long tradition of manufacturing cars,[29] there are currently no large-scale assembly line automobile manufacturers in the country.

| Top 25 imports and exports for Switzerland for 2009 [26] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 25 trading partners for Switzerland for 2009 [26] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tourism

Switzerland has a highly developed tourism infrastructure, especially in the mountainous regions and cities, making it a good market for tourism-related equipment and services.

14% of hotels were in Grisons, 12% each in the Valais and Eastern Switzerland, 11% in Central Switzerland and 9% in the Bernese Oberland. The ratio of lodging nights in relation to resident population ("tourism intensity", a measure for the relative importance of tourism to local economy) was largest in Grisons (8.3) and Bernese Oberland (5.3), compared to a Swiss average of 1.3. 56.4% of lodging nights were by visitors from abroad (broken down by nationality: 16.5% Germany, 6.3% UK, 4.8% USA, 3.6% France, 3.0% Italy) [30]

The total financial volume associated with tourism, including transportation, is estimated to CHF 35.5 billion (as of 2010) although some of this comes from fuel tax and sales of motorway vignettes. The total gross value added from tourism is 14.9 billion. Tourism provides a total of 144,838 full time equivalent jobs in the entire country. The total financial volume of tourist lodging is 5.19 billion CHF and eating at the lodging provides an additional 5.19 billion. The total gross value added of 14.9 billion is about 2.9% of Switzerland's 2010 nominal GDP of 550.57 billion CHF.[31][32]

Banking

In 2003, the financial sector comprised an estimated 11.6% of Switzerland's GDP and employed approximately 196,000 people (136,000 of whom work in the banking sector); this represents about 5.6% of the total Swiss workforce.[33]

Swiss neutrality and national sovereignty, long recognized by foreign nations, have fostered a stable environment in which the banking sector was able to develop and thrive. Switzerland has maintained neutrality through both World Wars, is not a member of the European Union, and was not even a member of the United Nations until 2002.[34][35]

Currently an estimated 28 percent of all funds held outside the country of origin (sometimes called "offshore" funds) are kept in Switzerland.[36] In 2009 Swiss banks managed 5.4 trillion Swiss Francs.[37]

The Bank of International Settlements, an organization that facilitates cooperation among the world's central banks, is headquartered in the city of Basel. Founded in 1930, the BIS chose to locate in Switzerland because of the country's neutrality, which was important to an organization founded by countries that had been on both sides of World War I.[38]

In May 2006, foreign banks operating in Switzerland managed 870 billion Swiss francs worth of assets.[39] In 2014, this number was estimated to be 960 billion Swiss francs.[40]

Workforce

The Swiss economy is characterised by a skilled and generally 'peaceful' workforce. One quarter of the country's full-time workers are unionised. Labour and management relations are amicable, characterised by a willingness to settle disputes instead of resorting to labour action. They take place between trade unions and branch associations, that are themselves often grouped in Union of Employers, like the Fédération patronale vaudoise or the Fédération des Entreprises Romandes Genève. About 600 collective bargaining agreements exist today in Switzerland and are regularly renewed without major problems. However, there is no country-wide minimum wage across sectors, but some collective bargaining agreement may contain minimum wage requirements for specific sectors or employers. A May 2014 ballot initiative which would have required a Swiss minimum wage to 22 Swiss francs an hour (corresponding to a monthly income of about 4000 Swiss francs) failed to pass, gaining only 23.7% support on the ballot.[41]

With the peak of the number of bankruptcies in 2003, however, the mood was pessimistic. Massive layoffs and dismissals by enterprises resulting from the global economic slowdown, major management scandals and different foreign investment attitudes have strained the traditional Swiss labour peace. Swiss trade unions have encouraged strikes against several companies, including Swiss International Air Lines, Coca-Cola, and Orange. Total days lost to strikes, however, remain among the lowest in the OECD.

Income and wealth distribution

In 2013 the mean household income in Switzerland was CHF 120,624 (c. USD 134,000 nominal, USD 101,000 PPP), the mean household income after social security, taxes and mandatory health insurance was CHF 85,560 (c. USD 95,000 nominal, USD 72,000 PPP).[42] The OECD lists Swiss household gross adjusted disposable income per capita USD 32,594 PPP for 2011.[43]

As of 2011, Switzerland had the highest average wealth per adult, at USD 540,000.[44] This development was tied to the exchange rate between the US Dollar and the Swiss franc, which caused capital in Swiss francs to more than double its value in dollar terms during the 2000s and especially in the wake of the financial crisis of 2007–2008, without any direct increase in value in terms of domestic purchasing power.[45]

Switzerland has the comparatively high Gini coefficient of 0.8, indicating unequal distribution.[46] The high average wealth is explained by a comparatively high number of individuals who are extremely wealthy; the median (50th percentile) wealth of a Swiss adult is five times lower than the average, at USD 100,900 (USD 70,000 PPP as of 2011).[47]

Economic policy

Terrorism

Through the United States-Swiss Joint Economic Commission (JEC), Switzerland has passed strict legislation covering anti-terrorism financing and the prevention of terrorist acts, marked by the implementation of several anti-money laundering procedures and the seizure of al-Qaeda accounts.

European Union

Apart from agriculture, there are minimal economic and trade barriers between the European Union and Switzerland. In the wake of the Swiss voters' rejection of the European Economic Area Agreement in 1992, the Swiss Government set its sights on negotiating bilateral economic agreements with the EU. Four years of negotiations culminated in Bilaterals, a cross-platform agreement covering seven sectors: research, public procurement, technical barriers to trade, agriculture, civil aviation, land transport, and the free movement of persons. Parliament officially endorsed the Bilaterals in 1999 and it was approved by general referendum in May 2000. The agreements, which were then ratified by the European Parliament and the legislatures of its member states, entered into force on June 1, 2002. The Swiss government has since embarked on a second round of negotiations, called the Bilaterals II, which will further strengthen the country's economic ties with the organisation.

Switzerland has since brought most of their practices into conformity with European Union policies and norms in order to maximise the country's international competitiveness. While most of the EU policies are not contentious, police and judicial cooperation to international law enforcement and the taxation of savings are controversial, mainly because of possible side effects on bank secrecy.

Swiss and EU finance ministers agreed in June 2003 that Swiss banks would levy a withholding tax on EU citizens' savings income. The tax would increase gradually to 35% by 2011, with 75% of the funds being transferred to the EU. Recent estimates value EU capital inflows to Switzerland to $8.3 billion.

Institutional membership

Switzerland is a member of a number of international economic organizations, including the United Nations, the World Trade Organization, the International Monetary Fund, the World Bank, and the Organisation for Economic Co-operation and Development.

International comparison

| Countries | Agricultural sector % | Manufacturing sector % | Services sector % | Unemployment rate % | Unemployment rate (females) % | Unemployment rate (males) % | Average hours worked per week |

|---|---|---|---|---|---|---|---|

| Switzerland (2006) [19] | 3.8 | 23 | 73.2 | 4.0 | 4.7 | 3.4 | 41.6 |

| European Union-25 countries (2006)[48] | 4.7 | 27.4 | 67.9 | 8.2 | 9 | 7.6 | 40.5 |

| Germany (2014)[49] | 2.1 | 24.4 | 73.5 | 5.2 | 4.9 | 5.5 | 41.2 |

| France (2006)[50] | 3.9 | 24.3 | 71.8 | 8.8 | 9.5 | 8.1 | 39.1 |

| Italy (2006)[51] | 4.2 | 29.8 | 66 | 6.6 | 8.5 | 5.2 | 39.3 |

| United Kingdom (2006)[52] | 1.3 | 22 | 76.7 | 5.3 | 4.8 | 5.7 | 42.4 |

| United States (2005)[53] | 1.6 | 20.6 | 77.8 | 5.1[54] | 5.6 [55] | 5.9 [55] | 41[56] |

Regional disparities

| Cantons | Tax index for all Federal, Cantonal and Church Taxes (Switzerland = 100.0) 2006 | Median Church, Local and Cantonal Tax Rate (2011) by Family Status and Pre-Tax Income[57] | Population under 20 as a percentage of total population aged 20–64 2007 | National Income per person in CHF 2005 | Change in National Income per person 2003-2005 | |||

|---|---|---|---|---|---|---|---|---|

| Unmarried | Married with 2 children | |||||||

| 80,000 CHF | 150,000 CHF | 80,000 CHF | 150,000 CHF | |||||

| |

100 | 14.43 | 21.12 | 4.9 | 12.29 | 34.59 | 54,031 | 5.3 |

| | 82.9 | 11.01 | 17.31 | 4.50 | 10.52 | 31.12 | 68,803 | 4.6 |

| | 123.1 | 14.75 | 21.96 | 6.79 | 14.23 | 33.05 | 45,643 | 5 |

| | 119 | 13.49 | 18.04 | 5.07 | 11.18 | 37.19 | 43,910 | 5.3 |

| | 144.2 | 11.95 | 15.76 | 5.91 | 10.84 | 37.06 | 45,711 | 5.3 |

| | 66.5 | 8.53 | 13.04 | 3.33 | 7.77 | 36.95 | 50,170 | 6.3 |

| | 146.5 | 11.21 | 14.88 | 7.11 | 11.01 | 40.88 | 39,645 | 4.7 |

| | 79.1 | 10.73 | 15.07 | 3.66 | 9.39 | 34.55 | 73,285 | 15.6 |

| | 134.8 | 11.99 | 17 | 5.51 | 11.22 | 36.85 | 73,236 | 10.9 |

| | 50.3 | 5.95 | 12.98 | 1.13 | 4.91 | 35.45 | 93,752 | 5.4 |

| | 126.4 | 15.18 | 21.88 | 5 | 12.89 | 40.2 | 39,559 | 2.6 |

| | 116.9 | 15.87 | 21.96 | 7.26 | 14.12 | 34.34 | 46,844 | 4.9 |

| | 113.1 | 14.98 | 20.61 | 3.9 | 13.36 | 26.6 | 115,178 | 15.9 |

| | 92.5 | 14.52 | 22.07 | 3.37 | 12.64 | 33 | 53,501 | 3.9 |

| | 114.6 | 13.68 | 20.1 | 5.63 | 11.44 | 32.92 | 55,125 | 5.4 |

| | 121.7 | 13.44 | 19.02 | 6.73 | 12.88 | 37.6 | 44,215 | 4.7 |

| | 105.6 | 11.68 | 16.68 | 5.13 | 10.79 | 44.46 | 45,936 | 7.4 |

| | 115.5 | 14.41 | 20.71 | 4.7 | 11.89 | 37.66 | 44,866 | 4 |

| | 112.2 | 13.79 | 20.16 | 3.97 | 11.37 | 33.97 | 49,355 | 11.7 |

| | 87.4 | 13.56 | 19.62 | 4.79 | 11.78 | 34.9 | 49,209 | 2.5 |

| | 86.6 | 13.58 | 18.89 | 4.38 | 11.52 | 37.52 | 44,918 | 3.2 |

| | 64.6 | 12.47 | 19.35 | 1.96 | 10.31 | 31.14 | 41,335 | 3.4 |

| | 106.2 | 15.44 | 21.77 | 5.09 | 13.14 | 37.87 | 52,901 | 3.4 |

| | 121.3 | 14.71 | 22.94 | 4.29 | 10.41 | 35.18 | 38,385 | 6 |

| | 137.1 | 18.44 | 25.5 | 8.5 | 16.94 | 38.06 | 49,775 | 6.6 |

| | 89.8 | 14.29 | 21.61 | 0.83 | 10.27 | 35.4 | 62,839 | 5.1 |

| | 126.6 | 17.22 | 24.76 | 7.7 | 16.16 | 40.09 | 38,069 | 6.4 |

- Source:[58]

See also

- Taxation in Switzerland

- Science and technology in Switzerland

- Swiss labour law

- Merchant Marine of Switzerland

- Economy of Europe

- Federation of the Swiss Watch Industry FH

- 2000-watt society

- Swiss National Bank

- Banking in Switzerland

Notes and references

Notes

- ↑ Includes federal, cantonal and municipal accounts

References

- ↑ Field listing - GDP (PPP), CIA World Factbook

- 1 2 3 4 5 6 7 8 9 10 "OECD.Stat – General Statistcs – Country statistical progiles: Switzerland". Organisation for economic co-operation and development. Retrieved 2016-01-18.

- ↑ http://www.imf.org/external/pubs/ft/weo/2016/02/weodata/weorept.aspx?sy=2016&ey=2021&scsm=1&ssd=1&sort=country&ds=.&br=1&c=146&s=PPPGDP%2CPPPPC&grp=0&a=&pr1.x=68&pr1.y=18

- ↑ "Doing Business in Switzerland 2013". World Bank. Retrieved 2012-10-22.

- 1 2 "Foreign trade – Indicators – Balance of trade: Principal business partners in 2014". Neuchâtel, Switzerland: Swiss Federal Statistical Office. 2016. Retrieved 2016-01-18.

- ↑ "Export Partners of Switzerland". CIA World Factbook. 2015. Retrieved 26 July 2016.

- ↑ "Import Partners of Switzerland". CIA World Factbook. 2015. Retrieved 26 July 2016.

- ↑ "Increase in Swiss official development assistance". Swiss Agency for Development and Cooperation - SDC. 2010-09-17. Retrieved 2010-10-11.

- ↑ "Sovereigns rating list". Standard & Poor's. Retrieved 26 May 2011.

- 1 2 3 Rogers, Simon; Sedghi, Ami (15 April 2011). "How Fitch, Moody's and S&P rate each country's credit rating". The Guardian. Retrieved 28 May 2011.

- ↑ "The Global Innovation Index 2015 : Effective Innovation Policies for Development" (PDF). Globalinnovationindex.org. Retrieved 2016-03-31.

- ↑ Regina Wecker, "Frauenlohnarbeit - Statistik und Wirklichkeit in der Schweiz an der Wende zum 20," Jahrhundert Schweizerische Zeitschrift für Geschichte (1984) 34#3 pp 346-356.

- ↑ World War 1 and Economic crisis, Britannica Encyclopedia

- ↑ Roman Studer, "When Did the Swiss Get so Rich?" Comparing Living Standards in Switzerland and Europe, 1800-1913, Journal of European economic history (2008) 37 (2), 405-452.

- ↑ National report on the Swiss Energy regime, BARENERGY project of EU,

- ↑ "Öffentliche Finanzen - Panorama" (in German). Bundesamt für Statistik (BFS). February 2013. p. 18.3. Retrieved 2013-05-22.

- 1 2 "Gross domestic product - quarterly estimates". Retrieved 2010-10-11.

- ↑ "Outlook T1" (PDF). Retrieved 2011-04-27.

- 1 2 Swiss Federal Statistical Office - Switzerland (German) accessed 21 December 2009

- 1 2 "Switzerland". The World Factbook. Central Intelligence Agency.

- 1 2 3 "Archived copy". Archived from the original on February 18, 2013. Retrieved February 20, 2013.

- 1 2 Organic Farming in Switzerland. By Urs Niggli.

- ↑ "SWISS ENVIRONMENTAL STATISTICS : 2006" (PDF). Bfs.admin.ch. Retrieved 2016-03-31.

- ↑ "MAX - Unsupported Browser Warning" (PDF). Ustr.gov. Retrieved 2016-03-31.

- ↑ "United Nations Statistics Division - Trade Statistics". Unstats.un.org. 2014-08-01. Retrieved 2016-03-31.

- 1 2 3 4 5 The Observatory of Economic Complexity database accessed 7 May 2012

- ↑ C.G. Schmutz (18 August 2015) Wenn die Armee immer weniger Munition kauft (German) Neue Zürcher Zeitung (Wirtschaft) accessed 18 August 2015

- ↑ Seco - Ausfuhr von Kriegsmaterialien im Jahr 2013 (German) accessed 18 August 2015

- ↑ Swiss car register accessed 7 May 2012

- ↑ Switzerland Tourism, "Swiss Tourism in Figures - 2007 "

- ↑ Swiss Federal Statistical Office - Tourism accessed 7 May 2012

- ↑ SECO Gross domestic product - quarterly estimates accessed 7 May 2012

- ↑ "The economic significance of the Swiss financial centre" (PDF). Swiss Bankers Association. Retrieved 2010-05-20. Kommunikation Unternehmen

- ↑ "The World Factbook - Switzerland - Introduction". Central Intelligence Agency. 2006-06-13. Retrieved 2006-06-17.

- ↑ "Country profile: Switzerland". BBC News. 2006-03-26. Retrieved 2006-06-17.

- ↑ The Boston Consulting Group "Global Wealth 2009"

- ↑ "The economic significance of the Swiss financial centre" (PDF). Swiss Bankers Association. Archived from the original (PDF) on February 17, 2010. Retrieved 2010-05-20.

- ↑ "Origins: Why Basel?". Bank of International Settlements. Retrieved 2006-06-16.

- ↑ "Foreign Banks In Switzerland Manage CHF870 Billion In Assets". Dow Jones. 2006-05-29. Retrieved 2006-06-15.

- ↑ Giles Broom (2014-05-20). "Foreign Banks in Switzerland Increase Client Assets, Group Says". Bloomberg. Retrieved 2016-03-31.

- ↑ "Statistik Schweiz - Mindestlohn-Initiative". Retrieved 2016-04-01.

- ↑ Haushaltseinkommen und -ausgaben 2013 Federal Statistical Office (Switzerland); exchange rate 0.90 in December 2013 (xe.com), PPP factor 1.322 as of 2013 (down from 1.851 in 2000) according to oecd.org

- ↑ National Accounts at a Glance 2014, OECD Publishing (2014), p. 66.

- ↑ "Global wealth has soared 14% since 2010 to USD 231 trillion with the strongest growth in emerging markets". Credit Suisse. 2011-10-19. Retrieved 2016-03-22. "In term of average wealth per adult in 2011, Switzerland, Australia and Norway are the three richest nations in the world, with Switzerland recording the highest average wealth per adult at USD 540,010".

- ↑ "Swiss fortunes in 2011 have more than doubled since 2000 in dollar terms" Franc's rise puts Swiss top of rich list, Simon Bowers, The Guardian, 19 October 2011. CHF 500,000 in late 2007 corresponded to USD 403,000 (USD 252,000 PPP), in late 2011 to USD 540,000 (USD 380,000 PPP) and in 2015 to USD 510,000 (USD 400,000 PPP). Exchange rates: xe.com, PPP conversion: 1.601 (2007), 1.433 (2011), 1.275 (2015) oecd.org.

- ↑ comparable to the United States, which also has a Gini coefficient close to 0.8, and a median wealth five times lower than average wealth. Switzerland's neighboring countries have Gini coefficients ranging between 0.6 and 0.73. See list of countries by distribution of wealth.

- ↑ Tages Anzeiger, Das reichste Land der Welt (20 October 2011) reports 3,820 individuals with a wealth of USD 50 million or more, out of a total population of just above 8 million.

- ↑ Swiss Federal Statistical Office - European Union (German) accessed 21 December 2009

- ↑ Swiss Federal Statistical Office - Germany (German) accessed 21 December 2009

- ↑ Swiss Federal Statistical Office - France (German) accessed 21 December 2009

- ↑ Swiss Federal Statistical Office - Italy (German) accessed 21 December 2009

- ↑ Swiss Federal Statistical Office - United Kingdom (German) accessed 21 December 2009

- ↑ Swiss Federal Statistical Office - United States (German) accessed 21 December 2009

- ↑ 2006 statistics

- 1 2 2002 statistics

- ↑ 2003 statistics

- ↑ Swiss Federal Tax Administration - Grafische Darstellung der Steuerbelastung 2011 in den Kantonen (German) (French) accessed 17 June 2013

- ↑ Regionale Disparitäten in der Schweiz - Schlüsselindikatoren (German) (French) accessed 20 December 2011

External links

| Wikimedia Commons has media related to Economy of Switzerland. |

- OECD's Switzerland country Web site and OECD Economic Survey of Switzerland

- SWISS MARKET IND

- Swiss Federal Statistical Office

- Gross Domestic Product Growth - Switzerland

- Swiss Economic Forecasts

- swissinfo.ch business news and articles

- World Bank Summary Trade Statistics Switzerland

- The Swiss Labour Law and Swiss employment contract

- Tariffs applied by Switzerland as provided by ITC's Market Access Map, an online database of customs tariffs and market requirements